Commodity booms and busts: Evidence from 1900 to 2015 | VOX, CEPR’s Policy Portal

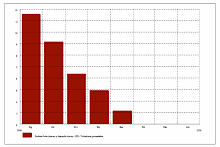

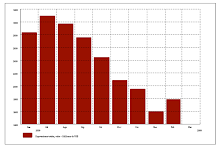

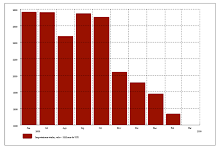

17. TASAS DE INTERES Peru

16. tipo de cambio sol/dolar-consulta del dia

V. SECCION: M. PRIMAS

1. SECCION:materias primas en linea:precios

![[Most Recent Quotes from www.kitco.com]](http://www.weblinks247.com/indexes/gfms.gif) |

METALES A 30 DIAS click sobre la imagen

(click sur l´image)

2. PRECIOS MATERIAS PRIMAS

9. prix du petrole

10. PRIX essence

petrole on line

30 abr 2015

28 abr 2015

Fwd: Macroperu Re: Las preguntas de Diego Ordóñez - Peruanos migrantes

From: asanchez_092004 <asanchez@inei.gob.pe>

Date: 2009/10/2

Subject: Macroperu Re: Las preguntas de Diego Ordóñez - Peruanos migrantes

To: MacroPeru@yahoogroups.com

Cifras de la migración internacional peruana: en el periodo 1990-2007, 1´940,817 peruanos salieron del país y no han retornado. Entre 1990-2008, los migrantes peruanos en el mundo remesaron al país US$ 16,408 millones de dólares. El Censo de Población y Vivienda 2007, registro 704 mil hogares peruanos con migración internacional.

A fin de aportar algo más la migración internacional peruana, comparto el libro: Peruanos Migrantes en la Ruta del Quijote, link: http://www2.inei.gob.pe/DocumentosPublicos/Peruanos_Migrantes_en_la_Ruta_de_El_Quijote.pdf

--- I

27 abr 2015

RV: La Newsletter du CEPII - Mars 2015

Enviado: lunes, 23 de marzo de 2015 07:35 a.m.

Para: ggarcianunez

Asunto: La Newsletter du CEPII - Mars 2015

11 Mars 2015 What is happening with Ukraine : economic and political snapshot 12 Mars 2015 Pietro Ichino & Pietro Garibaldi sur ''les effets du Jobs Act'' 24 Mars 2015 Les relations bilatérales France - Turquie 24 Mars 2015 Secular Stagnation: Housing to the Rescue? 9 Avril 2015 Moritz Schularick on: Credit and the Macroeconomy 9 Avril 2015 3ème Printemps de l'économie : "Mais où va donc la planète ?" 13 - 17 Avril, 2015 Michèle Debonneuil, Louis Gallois et Michel Fouquin sur : Mondialisation du commerce et de l'industrie : une nouvelle ère ? 16 Avril 2015 1st MENA Trade Workshop - Call for Papers - Deadline for submitting: Feb, 22 2 - 3 Juin, 2015 15th Doctoral Meetings in International Trade and International Finance - Call for paper - Deadline for submitting: March 9 25 - 26 Juin, 2015 L'Economie mondiale 2016 - SAVE THE DATE 9 Septembre 2015 XIII ELSNIT Annual Conference : Trade Facilitation - Call for Papers - Deadline for submitting: May, 15 23 - 24 Octobre, 2015 Agriculture, International Trade and Development - Call for Papers - Deadline for submitting: July 31 19 - 20 Novembre, 2015

|

ISSN: 1255-7072

Directeur de publication : Sébastien JeanRédacteur en chef : Dominique Pianelli | ||||||||||||||

Gérer son abonnement Les informations qui vous concernent sont strictement destinées au CEPII. Vous disposez d'un droit d'accès, de modification, de rectification et de suppression des données vous concernant (loi « Informatique et Libertés » du 6 janvier 1978 modifiée). Pour toute demande, adressez-vous à : cepiiweb@cepii.fr | |||||||||||||||

Etiquetas: 2015, abr2015, cepij, EURO, EXPORTACION, FRANCE, PPT_CRISIS, REGULACION

Los problemas deL Grupo Mexico en USA y el papel del Perú en el jucio de bancarrota.

2 copper mines in Peru spurring Grupo Mexico

Retaking Asarco is way to preserve huge stake in mines' parent company, analysts say

--

http://www.betaggarcian.blogspot.com/

Fwd: Macroperu Peru II: Centenario: Trayectoria del PBI per cápita 1830-2021

From: lbseminario <lbseminario@gmail.com>

Date: 2009/10/21

Subject: Macroperu Peru II: Centenario: Trayectoria del PBI per cápita 1830-2021

To: MacroPeru@yahoogroups.com

--

http://www.betaggarcian.blogspot.com/

LEAP/E2020 Press Review on the Global Systemic Crisis

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Etiquetas: 2013, CRISIS, ECONOMIA, geab, global, jun13, MACROECONOMICS, piketty, postcrisis, PRODUCCION, PRODUCTIVIDAD, RECESION

25 abr 2015

RT en Español: El gran armagedón financiero (E749) - Keiser Report en español

RT en Español: El gran armagedón financiero (E749) - Keiser Report en español. http://google.com/newsstand/s/CBIwmbPrsiE

15 abr 2015

12 abr 2015

11 abr 2015

9 abr 2015

6 abr 2015

Tweet de La Mula (@lamula)

[FOTOS] #FujimoriNuncaMás

(y de yapa, una cancioncita de Keiko) http://t.co/cQ6ETCl6ak http://t.co/Y2DPwXOyzh

(https://twitter.com/lamula/status/584910104555888640?s=03)

Etiquetas: 2015, AMERICALATINA, GONZALO GARCIA, POLITICA

4 abr 2015

Fw: real-world economics review - issue no. 66

real-world economics review - issue no. 66

- A journal of the World Economics Association (WEA) 12,557 members, join here

- Sister open access journals: Economic Thought and World Economic Review

- back issues at www.paecon.net recent issues: 65 64 63 62 61 60 59 58 57 56

http://www.paecon.net/PAEReview/issue66/whole66.pdf

You can download the whole issue as a pdf document by clicking here

Bernard Guerrien and Ozgur Gun download pdf 58

Shimshon Bichler and Jonathan Nitzan download pdf 65

Hubert Buch-Hansen download pdf 80

Jamie Morgan and Brendan Sheehan download pdf 95

New Paradigm Economics vs. Old Paradigm Economics download pdf 131

Your email subscriptions, powered by FeedBlitz, LLC, 9 Thoreau Way, Sudbury, MA 01776, USA. +1.978.776.9498

ENTREVISTAS TV CRISIS GLOBAL

Etiquetas

- 1 MAYO

- 2

- 2002

- 2007

- 2008

- 2009

- 2010

- 2011

- 2012

- 2013

- 2014

- 2015

- 2016

- 2o11

- 2OO9

- a

- abr2015

- abril09

- abril10

- acc

- actualidadecono

- AFP

- AFPS

- AFRICA

- Ago11

- AGOS

- AGOST10

- agost12

- AGOSTO2008

- AGOSTO2009

- agosto2015

- AGRO

- AGROEXPORTACION

- AIG

- AL

- ALAGROEXPORTACION

- ALEMANIA

- ALIMENTOS

- amazonia

- AMERICALATINA

- ANDAHUAYLAS

- APEC

- ARCH MES

- ARGENTINA

- asarco

- ASIA

- ATTAC

- australia

- AUTOMOVIL

- AVAAZ

- b

- BAILOUT

- baltic

- BANCOS

- BC

- BCE

- BCRP

- benassy

- benedetti

- BERNANKE

- bernis

- BIELORUSIA

- BIS

- blanchard

- BOE

- BOJ

- BOLIVIA

- BOLSA

- BONUS

- BRASIL

- BRIC

- BUBBLE

- bundesbank

- C

- c rec

- CAFE

- CAMBIOCLIMATICO

- CAMERICAS

- CAN

- CANADA

- CANCION

- CAPITALISMO

- castro

- CDO

- cepij

- CHAVEZ

- cheque

- CHILE

- chimerica

- CHINA

- CHRYSLER

- CICLO

- CIE

- ciencia

- CIP

- COBRE

- COLOMBIA

- COMERCIO

- commodities

- COMPUTO

- CONSTRUCCION

- CONSUMO

- CONTAGIO

- control

- COPENHAGUE

- CORRUPCION

- coursera

- CRECIMIENTO

- CREDITO

- CRISIS

- CUBA

- CUMBREALCUE

- CUMBREALCUSA

- davos

- DEC08

- DEC11

- dec12

- DEC13

- dec15

- DEFICIT

- DEFLACION

- demanda

- DEPRESION

- DERIVADOS

- DEUDA

- developpement

- DIC09

- DIC10

- dic12

- DICIEMBRE

- do

- DOLAR

- doubledip

- dsk

- dubai

- duracion

- ec

- ecologo

- ECONOMIA

- ECUADOR

- EDUCA

- efectos

- EMPLEO

- EN11

- en16

- EN2016

- encuesta

- ene016

- energia

- ENERO

- ENERO09

- enero10

- EST

- eu

- EURO

- expansion

- EXPORTACION

- f

- fannie

- feb09

- feb10

- feb13

- feb15

- FED

- filo

- fin

- FINANZAS

- FINLANDIA

- fisica

- flu

- FMI

- FONDOS

- fr

- FRANCE

- frankfurt

- frontrunning

- fukushima

- G20

- G7

- GAS

- geab

- GEITHNER

- gini

- GLO

- global

- GM

- GONZALO GARCIA

- grece

- GREENSPAN

- GRENOBLE

- gripeporcina

- grupo mexico

- HAITI

- hambre

- HEDGE FUNDS

- HIPOTECA

- hist

- HOLLANDE

- HONDURAS

- IMPORTACION

- IMPUESTOS

- INDE

- INDIGNADOS

- INDUSTRIAL

- INFLACION

- INFORMALIDAD

- INFRAESTRUCTURA

- INGENIERIA

- INGENIEROS

- innova

- INTEGRACION

- INTERNACIONAL

- INVERSION

- IRAN

- IRLANDA

- ISLANDIA

- ismea

- ITALIA

- IZQ

- JAPON

- JUL11

- JULIO08

- JULIO09

- JULIO15

- JUN09

- jun10

- jun11

- JUN12

- jun13

- jun15

- JUNIO08

- keynes

- KRUGMAN

- lagarde

- LAREPUBLICA

- leap

- leverage

- liquidez

- LITIO

- lme

- LR

- macro

- MACROECONOMICS

- madera

- MADOFF

- MAMBIENTE

- MANGO

- MARS09

- mars10

- marx

- matematicas

- MATERIASPRIMAS

- MATUK

- MAY09

- MAY11

- MAY12

- MAY13

- may15

- may2015

- MAYO

- MBS

- me

- mef

- MERKEL

- METALES

- MEXICO

- miga

- MIGRA

- MINERIA

- MODELES

- MONDE

- MONEDA

- mourey

- MUJICA

- MUNDO

- musica clasica

- NACIONALIZACION

- neural

- niño

- nobel

- NOTASEMANAL

- NOV08

- nov09

- nov10

- NOV11

- NOV12

- nov15

- nuclear

- OBAMA

- OCDE

- oct09

- oct10

- OCT11

- oct12

- OCTUBRE08

- OFCE

- OIT

- OMC

- ORO

- paita

- PANAMA

- PAPA

- PARADIS

- PARAGUAY

- PAULSON

- pbi

- pe

- PEÑAFLOR

- PERU

- pesca

- PETROLEO

- piketty

- PLAN

- PMI

- POBLA

- POBREZA

- POL

- POLITICA

- porter

- portugal

- postcrisis

- PPT_CRISIS

- PRODUCCION

- PRODUCTIVIDAD

- profits

- prog

- PROTECCION

- QUIEBRA

- r

- RECESION

- REGULACION

- REMESAS

- REPEC

- REPRISE

- REPSOL

- RESERVAS

- RETAIL

- RGE

- RIESGOPAIS

- RMBS

- ROBOTICA

- RODRIK

- ROUBINI

- RUSIA

- SALARIOS

- SARKO

- school paris

- sep11

- SEP15

- SEQUIA

- SERVICIOS

- set09

- set10

- set11

- set12

- SET15

- SETIEMBRE08

- SINGAPUR

- SIRIA

- sismo

- soros

- southern

- SPAIN

- STANFORD

- STIGLITZ

- SUBPRIMES

- SUISSE

- SYRIZA

- TAIWAN

- TARIFAS

- TAS

- TCAMBIO

- TECNOLOGIA

- TERRITORIO

- TEXTIL

- TINTERES

- TLC

- TPP

- trabajo

- trentin

- TRICHET

- TROIKA

- tsunami

- TURISMO

- TV

- UBS

- UE

- UK

- UKRANIA

- UNASUR

- URUGUAY

- USA

- v

- VENEZUELA

- VIDEO

- vivienda

- WALL STREET

- WS

- wsj

- YEN

- young

- YUAN

- Zbasura

- zerohedge

Peru:crisis impacto regional arequipa,raul mauro

Temas CRISIS FINANCIERA GLOBAL

claves para pensar la crisis

-Tipo de cambio

- DIARIOS DE HOY

PRESS CLIPPINGS-RECORTES PRENSA-PRESSE..

canciones de GRACIAS A LA VIDA !

ETIQUETAS alfabetico

- 1 MAYO

- 2

- 2002

- 2007

- 2008

- 2009

- 2010

- 2011

- 2012

- 2013

- 2014

- 2015

- 2016

- 2o11

- 2OO9

- a

- abr2015

- abril09

- abril10

- acc

- actualidadecono

- AFP

- AFPS

- AFRICA

- Ago11

- AGOS

- AGOST10

- agost12

- AGOSTO2008

- AGOSTO2009

- agosto2015

- AGRO

- AGROEXPORTACION

- AIG

- AL

- ALAGROEXPORTACION

- ALEMANIA

- ALIMENTOS

- amazonia

- AMERICALATINA

- ANDAHUAYLAS

- APEC

- ARCH MES

- ARGENTINA

- asarco

- ASIA

- ATTAC

- australia

- AUTOMOVIL

- AVAAZ

- b

- BAILOUT

- baltic

- BANCOS

- BC

- BCE

- BCRP

- benassy

- benedetti

- BERNANKE

- bernis

- BIELORUSIA

- BIS

- blanchard

- BOE

- BOJ

- BOLIVIA

- BOLSA

- BONUS

- BRASIL

- BRIC

- BUBBLE

- bundesbank

- C

- c rec

- CAFE

- CAMBIOCLIMATICO

- CAMERICAS

- CAN

- CANADA

- CANCION

- CAPITALISMO

- castro

- CDO

- cepij

- CHAVEZ

- cheque

- CHILE

- chimerica

- CHINA

- CHRYSLER

- CICLO

- CIE

- ciencia

- CIP

- COBRE

- COLOMBIA

- COMERCIO

- commodities

- COMPUTO

- CONSTRUCCION

- CONSUMO

- CONTAGIO

- control

- COPENHAGUE

- CORRUPCION

- coursera

- CRECIMIENTO

- CREDITO

- CRISIS

- CUBA

- CUMBREALCUE

- CUMBREALCUSA

- davos

- DEC08

- DEC11

- dec12

- DEC13

- dec15

- DEFICIT

- DEFLACION

- demanda

- DEPRESION

- DERIVADOS

- DEUDA

- developpement

- DIC09

- DIC10

- dic12

- DICIEMBRE

- do

- DOLAR

- doubledip

- dsk

- dubai

- duracion

- ec

- ecologo

- ECONOMIA

- ECUADOR

- EDUCA

- efectos

- EMPLEO

- EN11

- en16

- EN2016

- encuesta

- ene016

- energia

- ENERO

- ENERO09

- enero10

- EST

- eu

- EURO

- expansion

- EXPORTACION

- f

- fannie

- feb09

- feb10

- feb13

- feb15

- FED

- filo

- fin

- FINANZAS

- FINLANDIA

- fisica

- flu

- FMI

- FONDOS

- fr

- FRANCE

- frankfurt

- frontrunning

- fukushima

- G20

- G7

- GAS

- geab

- GEITHNER

- gini

- GLO

- global

- GM

- GONZALO GARCIA

- grece

- GREENSPAN

- GRENOBLE

- gripeporcina

- grupo mexico

- HAITI

- hambre

- HEDGE FUNDS

- HIPOTECA

- hist

- HOLLANDE

- HONDURAS

- IMPORTACION

- IMPUESTOS

- INDE

- INDIGNADOS

- INDUSTRIAL

- INFLACION

- INFORMALIDAD

- INFRAESTRUCTURA

- INGENIERIA

- INGENIEROS

- innova

- INTEGRACION

- INTERNACIONAL

- INVERSION

- IRAN

- IRLANDA

- ISLANDIA

- ismea

- ITALIA

- IZQ

- JAPON

- JUL11

- JULIO08

- JULIO09

- JULIO15

- JUN09

- jun10

- jun11

- JUN12

- jun13

- jun15

- JUNIO08

- keynes

- KRUGMAN

- lagarde

- LAREPUBLICA

- leap

- leverage

- liquidez

- LITIO

- lme

- LR

- macro

- MACROECONOMICS

- madera

- MADOFF

- MAMBIENTE

- MANGO

- MARS09

- mars10

- marx

- matematicas

- MATERIASPRIMAS

- MATUK

- MAY09

- MAY11

- MAY12

- MAY13

- may15

- may2015

- MAYO

- MBS

- me

- mef

- MERKEL

- METALES

- MEXICO

- miga

- MIGRA

- MINERIA

- MODELES

- MONDE

- MONEDA

- mourey

- MUJICA

- MUNDO

- musica clasica

- NACIONALIZACION

- neural

- niño

- nobel

- NOTASEMANAL

- NOV08

- nov09

- nov10

- NOV11

- NOV12

- nov15

- nuclear

- OBAMA

- OCDE

- oct09

- oct10

- OCT11

- oct12

- OCTUBRE08

- OFCE

- OIT

- OMC

- ORO

- paita

- PANAMA

- PAPA

- PARADIS

- PARAGUAY

- PAULSON

- pbi

- pe

- PEÑAFLOR

- PERU

- pesca

- PETROLEO

- piketty

- PLAN

- PMI

- POBLA

- POBREZA

- POL

- POLITICA

- porter

- portugal

- postcrisis

- PPT_CRISIS

- PRODUCCION

- PRODUCTIVIDAD

- profits

- prog

- PROTECCION

- QUIEBRA

- r

- RECESION

- REGULACION

- REMESAS

- REPEC

- REPRISE

- REPSOL

- RESERVAS

- RETAIL

- RGE

- RIESGOPAIS

- RMBS

- ROBOTICA

- RODRIK

- ROUBINI

- RUSIA

- SALARIOS

- SARKO

- school paris

- sep11

- SEP15

- SEQUIA

- SERVICIOS

- set09

- set10

- set11

- set12

- SET15

- SETIEMBRE08

- SINGAPUR

- SIRIA

- sismo

- soros

- southern

- SPAIN

- STANFORD

- STIGLITZ

- SUBPRIMES

- SUISSE

- SYRIZA

- TAIWAN

- TARIFAS

- TAS

- TCAMBIO

- TECNOLOGIA

- TERRITORIO

- TEXTIL

- TINTERES

- TLC

- TPP

- trabajo

- trentin

- TRICHET

- TROIKA

- tsunami

- TURISMO

- TV

- UBS

- UE

- UK

- UKRANIA

- UNASUR

- URUGUAY

- USA

- v

- VENEZUELA

- VIDEO

- vivienda

- WALL STREET

- WS

- wsj

- YEN

- young

- YUAN

- Zbasura

- zerohedge

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/spot-copper-30d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/zinc-d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/lead-d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/spot-nickel-30d.gif)