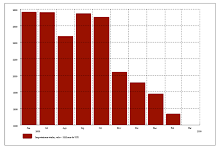

Ni la crisis de 2001 ni los coletazos del efecto tequila. Para encontrar una caída tan estrepitosa en las exportaciones argentinas hay que remontarse a los años de la hiperinflación.

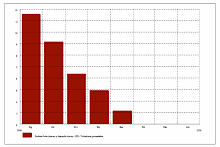

Las ventas argentinas al exterior retrocedieron en enero un 36 por ciento respecto del mismo mes del año pasado. De los 5810 millones de dólares exportados a comienzos de 2008, se pasó a 3730 millones, según difundió ayer el Indec en su informe de intercambio comercial.

El país no registraba una caída semejante desde diciembre de 1989, cuando las exportaciones mostraron un desplome del 37,8 por ciento. Debieron pasar 229 meses para que el sector externo volviera a arrojar un resultado tan negativo.

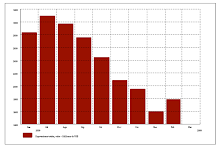

Las importaciones también registraron un fuerte descenso: pasaron de 4478 millones de dólares a US$ 2759 millones, un 38 por ciento menos de enero a enero. Hacía más de seis años que la Argentina no recortaba tan drásticamente sus compras al exterior. En noviembre de 2002 las importaciones cayeron 40 por ciento, en momentos en que los efectos de la devaluación todavía estaban frescos.

Esta doble caída permitió que el comercio exterior continuara registrando superávit, aunque el saldo de 971 millones de dólares fue un 27,1 por ciento más bajo que en enero de 2008.

Los productos que explican la mayor parte de la caída de las exportaciones son los cereales (básicamente trigo), grasas y aceites (especialmente de soja) y el material de transporte terrestre (autos). En las importaciones, se destacan los recortes en bienes intermedios (insumos), como porotos de soja y mineral de hierro.

"Va a ser bastante catastrófico este año", resumió, sin apelar a medias tintas, el presidente de la Cámara de Exportadores de la República Argentina (CERA), Enrique Mantilla. El empresario indicó que sus pronósticos para este año hablan de entre 55.000 y 60.000 millones de dólares de exportación, muy por debajo de los 78.300 millones de dólares anticipados por el Gobierno en el presupuesto.

Mantilla argumentó que hay diversos factores que confluyen para esta situación: la caída en los precios internacionales de las commodities , la sequía ("afectará las exportaciones en un 10 por ciento", calculó), la menor demanda externa por la recesión mundial y "el hecho de que por ciertas políticas regulatorias del Gobierno hay menor siembra y menor producción de carnes y lácteos". Mercosur en picada

Además, criticó la morosidad que mostraron en enero las autoridades fiscales en la devolución de los reintegros de la Aduana. "Se están retrasando como nunca", indicó.

El derrumbe no fue parejo hacia todas las regiones. El Mercosur resultó el bloque más golpeado (sin contar el poco significativo Magreb), con caídas del 51 por ciento en exportaciones y del 54 por ciento en importaciones. Casi la totalidad es intercambio con Brasil. De esta manera, Europa desplazó al socio natural del país como principal destino de las ventas argentinas.

"La disminución del comercio con el Mercosur explica el 36 por ciento de la caída total de las exportaciones y el 50 por ciento de las importaciones", expresó Pablo Besmedrisnik, economista de la Fundación Crear. "Más que nunca hay que prestar atención a la relación con Brasil y a los mecanismos de administración del comercio."

Además, destacó que los resultados conocidos ayer muestran que "también cae la base imponible para aranceles y retenciones, con lo cual la recaudación fiscal se resentirá".

Su colega Mauricio Claverí, de la consultora abeceb.com, recordó que un factor que explica la abrupta caída es que la comparación se realiza con enero de 2008, un mes que fue especialmente bueno porque se reabrieron los registros de exportación de trigo, que estaban cerrados en 2007. "Y ahora prácticamente no hay cereales para exportar y lo poco que se exporta se vende a precios más bajos", afirmó.

En tanto, Osvaldo Cado, de la consultora Prefinex, indicó que aunque la caída de las exportaciones era previsible, la de las importaciones es un dato llamativo. "Cayeron bienes de capital y de consumo, además de vehículos utilitarios. Eso se debe a que no se está invirtiendo casi nada, y también a la incertidumbre por lo que está pasando con el tipo de cambio. Con esta caída de las importaciones, se confirma que el país entró en recesión", afirmó.

La CIA pronostica inestabilidad en el país

WASHINGTON (AP).- La Argentina, Ecuador y Venezuela enfrentan una dura situación económica y podrían sufrir inestabilidad ante la crisis económica mundial, advirtió ayer el director de la CIA, Leon Panetta. Panetta dijo a la prensa que la Agencia Central de Inteligencia tiene que prestar atención al impacto de la recesión en todo el mundo. En su primer encuentro abierto con los medios, Panetta dijo que la CIA debe saber cómo afecta la economía las políticas internacionales de China, Rusia y otros países. El nuevo jefe de la CIA dijo que la agencia de espionaje ha emitido por primera vez de manera diaria el Informe de Inteligencia Económica. El documento aborda asuntos económicos y políticos en el extranjero, para informar al gobierno del presidente Barack Obama.

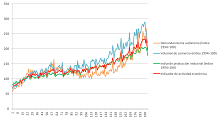

17. TASAS DE INTERES Peru

16. tipo de cambio sol/dolar-consulta del dia

V. SECCION: M. PRIMAS

1. SECCION:materias primas en linea:precios

![[Most Recent Quotes from www.kitco.com]](http://www.weblinks247.com/indexes/gfms.gif) |

METALES A 30 DIAS click sobre la imagen

(click sur l´image)

2. PRECIOS MATERIAS PRIMAS

9. prix du petrole

10. PRIX essence

petrole on line

26 feb 2009

argentina:exportqcion cqe 36 por ciento; la nacion

Etiquetas: 2009, AMERICALATINA, ARGENTINA, CRISIS, DEFICIT, DEFLACION, EXPORTACION, feb09, FINANZAS, INTERNACIONAL, RECESION

24 feb 2009

BBCMundo.com: Al rescate de las bolsas

BBCMundo.com Nota recomendada por gonza

** Al rescate de las bolsas **

En medio de pronunciadas caídas de las acciones, Japón habla de un rescate estatal de los fondos bursátiles.<!-Economía, Japón, Bolsas-->

< http://news.bbc.co.uk/go/em/fr/-/hi/spanish/business/newsid_7907000/7907699.stm >

**

19 feb 2009

Fwd: + de la crisis en USA

Thursday, February 19, 2009; Page A06

The federal government yesterday doubled its commitment to Fannie Mae and Freddie Mac, promising to reimburse the companies for up to $400 billion in losses on their investments in mortgage loans.

The massive expansion of the government backstop is a response to mounting strains on the two companies, officials said.

It was announced as part of the Obama administration's broad plan to reduce foreclosures, which will further squeeze the companies' revenue by requiring the pair to refinance or modify millions of loans to lower monthly payments.

And it comes as a souring economy is pushing more borrowers to default. Fannie and Freddie estimate they will need up to $65 billion from the original $200 billion backstop to cover their losses on mortgage-related investments in the second half of 2008.

"It is crucial to maintain confidence in these institutions even under worse-than-expected economic conditions," Treasury Secretary Timothy F. Geithner said yesterday in a statement announcing the new aid package.

The companies, both based in the Washington area, were seized by the government in September to stabilize their role as the main funding source for mortgage lending. Fannie and Freddie buy loans from originators such as banks, allowing new loans to be made before existing ones are repaid.

At the time, the government promised to cover the companies' losses, injecting money in any quarter when the companies' liabilities exceed their assets, up to $100 billion each. Fannie and Freddie raise money from private investors to fund their loan purchases, and the government wanted to reassure those investors that the companies would be able to repay their debts.

Officials said in September that $200 billion was much more money than the companies would need. Officials now acknowledge that won't be enough to calm investors. Yesterday, they said that $400 billion would be much more money than the companies would need.

"Resetting these agreements from $100 to $200 billion each should remove any possible concerns debt and mortgage-backed securities investors have about the strong commitment of the U.S. government to support Fannie Mae and Freddie Mac," said James B. Lockhart III, director of the Federal Housing Finance Agency, which oversees the companies.

The Obama plan also increases by $100 billion, to $1.8 trillion, the volume of mortgage loans the two companies can own. The change has the effect of allowing the companies to sell more debt to raise money to buy additional loans. The administration also said that the Treasury would continue to buy securities created by the two companies, easing the pressure to find private investors. Both moves will tend to reduce the cost of financing mortgages, holding down interest rates for customers.

The expanded backstop was criticized by Republican lawmakers who have long pushed for the government to reduce the size of the two companies.

"Why should we reward Fannie Mae and Freddie Mac with $200 billion in taxpayer dollars without first reforming these housing entities that were at the heart of the economic meltdown?" House Minority Leader John A. Boehner (R-Ohio) said in a statement.

That debate remains in the offing, but the financial crisis has only increased the importance of the companies' health. As other sources of financing disappeared, Fannie and Freddie bought or agreed to buy about three-quarters of all new mortgage loans last year.

Now the companies also will play a central role in the Obama administration's plan. Officials described the effort as requiring sacrifices by private firms, but the greatest costs will be incurred by two in which the government owns an 80 percent stake.

Fannie and Freddie have been instructed to offer up to 5 million refinancings and to modify millions of additional mortgage loans. The plan is intended to benefit the companies in the long term by avoiding defaults on many of the loans, but only by reducing the amount they collect each month.

Staff writer Zachary Goldfarb contributed to this report.

--

Daniel Peñaflor Rivas

Kenyan Address

Convent Road N40, Nairobi Kenya,

Home +254 4348400

Mobile +254 714222821

--

http://www.betaggarcian.blogspot.com/

ARGENTINA: RECESION INDUSTRIAL

Volvió a caer la industria en enero y va hacia una recesión

El retroceso osciló entre el 9,1 y el 11,4%, según informes privados; la UIA contradice al Indec

Etiquetas: 2009, ARGENTINA, CONSUMO, CRISIS, DEFLACION, feb09, INDUSTRIAL, PRODUCCION, RECESION

Fwd: Macroperu El Retorno de los Controles de Capitales

bruno seminario

¡Cómo cambia todo ! En este artículo W. Buiter nos decribe como en estge momento se generlizan los controles de capitales en las economías emergentes; incluso, parece que ahora son recomendados por el propio Fondo Internacional. Hace algunos años quien proponía un idea semjante era acusado de enemigo del progreso , amante de edad piedra

i, etc.

The return of capital controls

February 18, 2009 10:43pm

When Iceland's banking system and currency collapsed last September, a key component of the emergency package that was introduced under the auspices of the IMF were controls on capital outflows, implemented through rigorous foreign exchange controls. This made sense. The currency was in free fall. The foreign exchange markets had seized up. There was no level of domestic interest rates the Central Bank of Iceland (which had zero credibility at this stage) could set that would induce domestic and foreign investors to hold on to their Icelandic kroner rather than converting them into euro, US dollars, sterling or any other serious convertible currency.

Capital controls in CEE

Iceland is about to have company. The most likely candidates for the imminent imposition of capital controls are in Central and Eastern Europe (CEE) and among the CIS countries. We can expect to see capital controls imposed even by some of the EU members from Eastern Europe that have not yet adopted the euro as their currency (the Baltics, Bulgaria, the Czech Republic, Hungary, Poland, and Romania).

All these countries have banking sectors that are overwhelmingly foreign-owned. With the de-globalisation and repatriation of the cross-border banking sector that is underway, parent banks (mainly in Western Europe) have become progressively less able and/or less willing to finance their subsidiaries in Central and Eastern Europe. The resulting financial stresses in the host countries have led the ECB to take the extremely unusual step of making swap facilities available to the central banks of two non-Eurozone EU members, Hungary and Poland. Hungary, which suffers from long-standing fiscal incontinence, has an IMF program as well.

The financial support from the ECB (and from the EC) is probably not unrelated to the fact that a number of Eurozone commercial banks are heavily exposed in CEE and the CIS. Austrian banks, in particular, have a massive exposure to the former Austro-Hungarian empire, as does Unicredit (an Italian bank) and several Nordic banks are at risk throughout the region, from the Baltics to Ukraine.

In most CEE countries, households and non-financial corporations played the reverse carry trade by borrowing in the foreign currencies with the lowest interest rates, oblivious to the exchange risk this involved. These CEE counterparts of Mrs Watanabe did so without having any natural foreign exchange hedges (foreign currency assets or income) and without taking out any synthetic hedges. Households throughout CEE have Swiss-franc-denominated residential mortgages. I am surprised there weren't more yen-denominated residential mortgages taken out! With the sharp decline in the external value of their currencies (the Polish zloty has declined against the euro by more than 35 percent since its peak in mid-2008, the Hungarian forint by 26 percent and the Czech koruny by 22 percent), the real value of their debt and debt service has increased sharply. Fortunately, most of these mortgages have long remaining maturities.

The same does not hold for the foreign currency debt taken on by the non-financial corporate sector in CEE. Much of this has a short maturity. In addition, during the period prior to the middle of 2008, when their currencies were appreciating, many CEE corporates bet on further appreciation of their currencies by writing puts on them. With their currencies way down, these corporates find themselves having to buy zloty, say, from the buyers of these puts, in exchange for euro at a much higher price for the zloty in terms of the euro than the current spot exchange rate, let alone the exchange rate anticipated when these CEE corporates wrote the puts. A further collapse of the currency would raise the likelihood and incidence of defaults among corporate borrowers.

The banks in CEE may have both assets and liabilities denominated to a large extent in foreign currency. Because their clients are not currency-matched, the banks have replaced currency risk on their balance sheets with credit risk.

Some of the CEE countries were the victims of wild domestic credit and asset market booms and bubbles even before they were hit by the global credit crunch (through the drying up of funding for the local subsidiaries by the parent banks). Latvia is the most extreme example, but Estonia and, to a lesser degree Lithuania, were also caught up in classic, post-reform unsustainable emerging-market booms, with out-of-control construction industries and epic current account deficits. Bulgaria, which like the Baltics has a currency board vis-a-vis the euro, Romania and Poland (both with floating exchange rates) also ran growing current account deficits that had unsustainability warning lights flashing.

All CEE countries, including those that had unsustainable domestic credit and asset market booms, are being hit hard by the domestic impact of the global credit crunch and by the collapse of world trade. The Czech Republic and Poland are the two CEE non-Eurozone members least likely to impose capital controls. The rest range from possible to quite likely.

The imposition of capital controls on a temporary basis to deal with a foreign exchange crisis/balance of payments emergency is compatible with the EU Treaties. Indeed, de-facto informal foreign exchange rationing has been taken place for quite a while in some countries. When I was in Latvia a year ago, local commercial bankers told me that if someone wished to borrow lat (the local currency), they would not lend it to him if the bank thought he was likely to use it to speculate against the currency peg of the lat with the euro. This is against the rules - indeed against the law — but it happened. Where could the frustrated would-be short seller of the Lat go to complain? To the Latvian central bank?

Of course, an EU country that imposes capital controls could forget about joining the Eurozone in the foreseeable future, unless the Maastricht criteria for EMU membership were waved or scrapped. Although the unconditional offer of immediate full EMU membership to all EU members would be a wise and wonderful contribution to the stabilisation of the region, I consider it unlikely that such wisdom will indeed be found in Frankfurt, Brussels and the national capitals of the EU - inhabited as these locations are by bears of very little brain. With Eurozone membership years away, the cost of imposing capital controls, in terms of further delays in EMU accession, would be minor.

Some of the non-EU countries in the Balkans (Albania, Bosnia-Herzegovina, Croatia, Macedonia, Serbia) are also likely to have recourse to capital controls before long. Montenegro already has the euro as its currency, despite not being a member of the Eurozone. Among the CIS countries that are likely candidates for the imposition of capital controls are Ukraine, Russia Kazakhstan.

Capital controls in Russia, Ukraine and Kazakhstan

Ukraine is in an economic and political mess. Its banking system is a triumph of hope over fair value. Its currency is weakening rapidly. Its export-oriented heavy industry and its agricultural sector have been hit hard by declining prices and world demand. It has an IMF program.

Russia has gone from Himmelhoch jauchzend to zum Tode betrübt in the space of less than a year. With oil at $140 a barrel and $460 bn of foreign exchange reserves, Russia felt and acted like a would-be super power. With oil at $40 a barrel and reserves draining fast in an unsuccessful attempt to stabilise the Rouble without raising interest rates, Russia looks increasingly like Venezuela with nukes. Industrial production has collapsed and the public finances are under severe strain. Russia's industry has borrowed heavily abroad, in foreign currency, and on a short-term basis. Its banking system can no longer fund itself in the international wholesale markets. Russia 2009 looks more and more like Russia 1998. Capital controls would be an obvious tool to regain control of the Rouble without having to engage in immediate heroic monetary and fiscal policy tightening. Even if the anti-capital controls faction in the Russian leadership wins the ongoing argument with the pro-capital controls faction, events may well force the hand of the authorities.

Kazakhstan may have enough financial resources and gas/oil revenues (despite the decline in oil prices) to get through the financial storm and the global slump without being forced to impose capital controls. It already had one major bail-out of its banks, however, and if Russia and Ukraine were to impose capital controls, Kazakhstan may well follow.

The joys and pain of an open capital account

For countries with a minor-league currency (every currency except for the US dollar, the euro and the yen), an open capital account will always be a mixed blessing. The joys of an open capital account - the undoubted benefits from decoupling domestic capital formation from national saving and from unrestricted international portfolio diversification and risk trading - cannot be enjoyed without the pain: the risk of its domestic financial institutions, capital markets, non-financial enterprises, consumers and public finances becoming the flotsam and jetsam on massive and mindless killer waves propelled by an out-of-control global financial storm.

Capital controls permit monetary and fiscal policy to be directed to the stabilisation of economic activity without having to worry about a collapse of the currency and its deleterious effects on the sectoral and national balance sheets. Of course capital controls will leak. They always leak. But provided they are enforced aggressively, say, with transgressors stoned to death in public after a fair trial, they can be made to work well enough to regain control of monetary and fiscal policy. And capital controls will leak progressively more copiously, the longer they are in place. Which is why their imposition should be viewed as temporary, with a gradual relaxation as economic conditions improve and global financial stability returns. Capital controls create rents whose allocation is at the discretion of public officials. They therefore encourage bribery, graft and corruption. Which is again why they should only be temporary.

The emerging markets of CEE and the CIS (and indeed emerging markets everywhere) have been progressively cut off from new external funding as the crisis deepened. At this stage, imposing capital controls (only controls on capital outflows really matter, at this stage; controls on capital inflows should have been imposed earlier) would not bring with it a heavy cost in terms of a sudden stop on capital inflows. That stop has happened already. Imposing capital outflow controls may discourage future capital inflows. The example of Malaysia, which imposed capital controls during the Asian crisis of 1997 suggests that foreign capital either has a short memory or can be convinced.

Conclusion

I predict that at least some of the emerging market countries of CEE and the CIS will impose capital controls before long. I recommend that emerging markets everywhere consider this option seriously.

February 18, 2009 10:43pm in Economics, European Union, Financial Markets, International Trade, Monetary Policy, Politics 1 link

Change settings via the Web (Yahoo! ID required)

Change settings via email: Switch delivery to Daily Digest Switch format to Traditional

Visit Your Group Yahoo! Groups Terms of Use Unsubscribe

--

http://www.betaggarcian.blogspot.com/

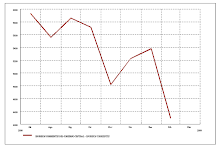

Trafico de Contenedores en el puerto de los Angeles.

WEDNESDAY, FEBRUARY 18, 2009

LA Area Ports: Exports Decline in January

by CalculatedRisk on 2/18/2009 04:46:00 PM

The LA area port traffic data, released today, suggests U.S. exports continued to decline in January.Click on graph for larger image in new window.

This graph shows the combined loaded inbound and outbound traffic at the ports of Long Beachand Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported.

Inbound traffic was 14% below last January. This slowdown in imports (inbound traffic to the U.S.) is hitting Asian countries hard. There was a slight increase from December to January, but that appears to be mostly seasonal (the data is NSA).

For the LA area ports, outbound traffic continued to decline in January, and was 28% below the level of January 2008. Export traffic is now at about the same level as in 2005. The suggest U.S. exports continued to decline in January after declining sharply in the 2nd half of 2008.

--

http://www.betaggarcian.blogspot.com/

Fwd: Macroperu Greenspan y la nacionalización

Stress testing "nationalization"

Wed Feb 18, 4:51 pm ET

Simply put: Nationalizing ailing banks means the government would tell bank execs to take a hike, and then oversee taxpayer dollars as they course through the banking sector's veins. When all is well, perhaps after selling assets and operations to new private investors, the government then steps back and lets a newly regulated bank sector float on its way.

Arguments for bold government action range from the passionate (Michael Hirsh of Newsweek) to the elegant (Nicholas Kristof of the New York Times). In any case, the number of economists and columnists calling for an aggressive takeover of our "zombie banks" is growing.

This week, respected economists Nouriel Roubini and Matthew Richardson laid it all out in a Washington Post op-ed:

"The U.S. banking system is close to being insolvent, and unless we want to become like Japan in the 1990s -- or the United States in the 1930s -- the only way to save it is to nationalize it….Nationalization is the only option that would permit us to solve the problem of toxic assets in an orderly fashion and finally allow lending to resume. Of course, the economy would still stink, but the death spiral we are in would end.

One could ignore this pessimistic view if Roubini hadn't been consistently correct in his predictions for our worsening economy. Roubini, or "Dr. Doom," as some have called him, is one of the few who saw the housing meltdown coming and who actually voiced his concerns years before it happened.

In a recent interview with Bill Moyers, Simon Johnson, a former chief economist of the International Monetary Fund, argues that many of the executives and members of the banking lobby need to be fired or flushed out, though he stops just short of explicitly calling it nationalization.

Another former IMF economist, however, does not. Ken Rogoff, a Harvard professor who was at the IMF with Treasury Secretary Tim Geithner, thinks government receivership of insolvent banks is becoming our only option. In a roundtable discussion on "PBS NewsHour," Rogoff predicted Geithner and his aides will come to the same conclusion once they "stress test" more Wall Street balance sheets.

Nobel-winning economist and New York Times columnist Paul Krugman was one of the first to note that Geithner's new financial rescue plan does not rule out nationalization. Krugman points to Geithner's "stress tests" as a possible first step in the temporary government takeover of crumbling banks:

"Will those public-private partnerships end up being a covert way to bail out bankers at taxpayers' expense? Or will the required "stress test" act as a back-door route to temporary bank nationalization (the solution favored by a growing number of economists, myself included)? Nobody knows."

Krugman notes in a following column just how quickly the idea of nationalization is picking up steam, even among conservatives:

"There's hope that the bank rescue will eventually turn into something stronger. It has been interesting to watch the idea of temporary bank nationalization move from the fringe to mainstream acceptance, with even Republicans like Senator Lindsey Graham conceding that it may be necessary."

On "This Week" on ABC, Graham argued for nationalization, while Democratic Sen. Chuck Schumer glowingly endorsed Geithner's seemingly less-than-aggressive rescue plan.

Meawhile, on NBC's "Meet the Press," senior White House adviser David Axelrod was asked if nationalization was off the table. Axelrod said it was not, indicating the Obama administration will do whatever it takes to right the nation's financial ship.

However, President Obama has publicly indicated he is against nationalization, for now. When asked about Sweden and how it temporarily nationalized its banks in the early 1990s, saving its economy from an extended slump, Obama noted that Sweden is a different kettle of fish, a rather smaller and socialist one to be exact.

When ABC's George Stephanopoulos asked Rep. Maxine Waters (D-Calif.) about nationalization on "This Week," she said she wasn't quite ready to take that route herself. But she also pointed to the national semantics surrounding the question as the first key hurdle to clear:

"Well, George, as you know, the word "nationalization" scares the hell out of people. And so the debate has been opened up now, and that's good. Let's talk about it."

- Thomas Kelley

**Yahoo! News bloggers compile the best news content from our providers and scour the Web for the most interesting news stories so you don't have to.

Change settings via the Web (Yahoo! ID required)

Change settings via email: Switch delivery to Daily Digest Switch format to Traditional

Visit Your Group Yahoo! Groups Terms of Use Unsubscribe

--

http://www.betaggarcian.blogspot.com/

Etiquetas: 2009, BANCOS, CRISIS, feb09, FINANZAS, INTERNACIONAL, NACIONALIZACION, USA

Fwd: Macroperu Predicciones oficiales

Fed says US economy will get worse in 2009

Fed says American economy will get worse in 2009, no sign housing market will stabilize

Jeannine Aversa, AP Economics Writer

Wednesday February 18, 2009, 7:31 pm EST

WASHINGTON (AP) -- The Federal Reserve warned Wednesday that the nation's crippled economy is even worse than thought and predicted it would deteriorate throughout 2009, with no sign that the housing market will stabilize.

The Fed's bleak estimates indicated that unemployment could climb as high as 8.8 percent this year and that the economy would contract for a full calendar year for the first time since 1991.

The central bank's latest projections came hours after a separate report showed that new home construction and applications for future projects both fell to record lows last month.

Still, some economists saw a silver lining in the otherwise dismal housing report: Scaled-back building should reduce the number of unsold homes and contribute to an eventual housing recovery.

The reports raise the stakes for the plan President Barack Obama announced Wednesday to curb foreclosures and ease the broader U.S. housing slump that sent the economy into recession.

The Fed's latest forecast says the unemployment rate will climb to between 8.5 and 8.8 percent this year. The old prediction, issued in mid-November, estimated that the jobless rate would rise to between 7.1 and 7.6 percent.

Many private economists believe the current 7.6 percent jobless rate -- the highest in more than 16 years -- will hit at least 9 percent by early next year even with the $787 billion stimulus package signed into law Tuesday by Obama.

The Fed also believes the economy will contract this year between 0.5 and 1.3 percent. The old forecast said the economy could shrink by 0.2 percent or expand by 1.1 percent.

The last time the economy registered a contraction for a full year was in 1991, by 0.2 percent. If the Fed's new predictions prove correct, it would mark the weakest showing since a 1.9 percent drop in 1982, when the country had suffered through a severe recession.

The grim outlook represents the growing toll of the worst housing, credit and financial crises since the 1930s. All of those negative forces have plunged the nation into a recession, now in its second year.

"Given the strength of the forces currently weighing on the economy," Fed officials "generally expected that the recovery would be unusually gradual and prolonged," according to documents on the Fed's updated economic outlook.

In another sign of the troubled economy, production at the nation's factories, mines and utilities fell 1.8 percent last month, more than economists expected. That figure, the third monthly drop in a row, was dragged down by a 23 percent drop in production at auto plants and their suppliers.

Meanwhile, construction of new homes and apartments plummeted 16.8 percent in January from the previous month, the Commerce Department said, falling to a seasonally adjusted annual rate of 466,000 units, a record low. Analysts expected a pace of 530,000 housing units.

Building permits, a measure of future activity, also sank to a record low pace of 521,000 units in January, a 4.8 percent drop from the prior month.

"Conditions in the market for new homes have not been this bad since the 1930s, and they continue to worsen," said Patrick Newport, an economist at IHS Global Insight in Lexington, Mass. He predicted that housing starts would remain depressed for months to come.

But other economists saw some glimmers of hope in the report. The sharp cuts in new home building should help reduce inventories of unsold homes, which reached record levels last year, and stabilize home prices, which have been battered by a flood of foreclosed homes on the market.

Abiel Reinhart, an economist at JPMorgan Chase & Co., said that reduced homebuilding lowers economic growth in the short run, "but it does help get inventories down to more reasonable levels."

Builders have cut the number of new homes on the market for almost two years, Newport said, but sales have fallen even more quickly. As a result, the Commerce Department said last month that it would take 12.9 months to sell all the new homes on the market, the longest on record.

That could drop closer to five to six months by the end of this year, Reinhart said, levels that are consistent with a more stable market.

The housing sector also got a boost Wednesday from the Obama administration, which unveiled a $75 billion effort to prevent up to 9 million Americans from losing their homes.

The plan also will double the size of the lifeline the government is providing Fannie Mae and Freddie Mac to $200 billion each as a way of reassuring financial markets of the viability of both mortgage finance giants.

David Crowe, chief economist for the National Association of Home Builders, said the administration's foreclosure program plus help for first-time home buyers included in the stimulus measure would have an impact.

"I do think we will see a bottom in 2009 and by the end of this year we will start to see the beginning of a recovery," he said. "But it will be a slow recovery because of the significant overhang of empty houses for sale."

The Fed was more pessimistic when it released a set of new economic projections and the minutes of its Jan. 17-19 meeting.

Members of the Fed's open market committee "saw no indication that the housing sector was beginning to stabilize," the minutes said.

While falling home prices and historically low mortgage rates have made homes more affordable, the Fed said, "concerns that house prices may fall further appeared to be holding back potential buyers."

Despite the lower unemployment and overall economic projections from the Fed, Joshua Shapiro, chief U.S. economist at MRF Inc., said the growth estimates for this year and next remain "much too optimistic."

The Fed forecast calls for the jobless rate to dip to between 8 and 8.3 percent next year, and to between 7.5 and 6.7 percent in 2011. The normal range for unemployment is around 5 percent.

Employment is usually the last piece of the economy to heal once the country is out of recession and in recovery mode. Businesses are usually reluctant to ramp up hiring until they feel confident that any recovery has staying power.

Under the Fed's new projections, the economy should grow between 2.5 and 3.3 percent next year and by as much as 5 percent in 2011, which would be considered robust.

Shapiro is not convinced. The central bank's forecasts are in the "'hope springs eternal camp,'" he said.

AP Economics Writers Christopher S. Rugaber and Martin Crutsinger contributed to this report.

--

http://www.betaggarcian.blogspot.com/

bruno seminario,Fwd: Macroperu Los problemas de la CEE

By Emma Ross-Thomas

Feb. 18 (Bloomberg) -- Germany and France may be forced to contemplate the bailout of entire nations rather than just individual banks as European government budgets buckle under the weight of recession.

German Finance Minister Peer Steinbrueck became the first senior policy maker to broach the topic earlier this week, saying some of the 16 euro nations are "getting into difficulties" and may need help. He went further today, saying Germany would show its "ability to act." French officials are also concerned about market tensions as the cost of insuring Irish, Greek and Spanish debt against default rises to records and bond spreads widen.

The nightmare for Angela Merkel and Nicolas Sarkozy is that widening deficits will prompt investors to shun the debt of some countries, sparking a region-wide crisis. While few investors are yet forecasting any defaults, the mere risk of it may prompt the bloc's two richest economies to ignore the European Central Bank and announce their willingness to come to the rescue.

"When push comes to shove Germany, France, the larger players will bail out those smaller peripheral players," said Alex Allen, chief investment officer of Eddington Capital Management. "You can't let one part of the system fail because it leads to failure of the whole system."

Allen's betting that the risk at least one nation will leave the bloc is higher than the market currently expects.

Swelling Deficits

European deficits have ballooned as governments from Berlin to Dublin committed more than 1.2 trillion euros ($1.5 trillion) to save their banking systems from collapse. The European Commission urged countries to bring their deficits back in line today as EU Monetary Affairs Commissioner Joaquin Almunia said the best way Greece and Ireland could deal with market pressure was by strengthening their finances.

The European Union's executive arm forecasts a deficit of 11 percent in Ireland, 6.2 percent in Spain and 4.6 percent in Portugal this year, compared with an average gap for the euro region of less than 1 percent in 2007.

European officials have already expressed concern that their bond market could potentially face a crisis similar to that unleashed by the collapse of Lehman Brothers Holdings Inc. in September. ECB board member Lorenzo Bini Smaghi said Feb. 12 there's a "risk that the mistrust that there is today in financial markets" is "transformed into mistrust in states."

Bond Spreads

"I would be very reluctant to say: 'O.K., let Ireland or Greece default, the market will sort it out, punish them for their irresponsibility of the past,'" said Thomas Mayer, co-head of global economics at Deutsche Bank AG in London. "They tried it with Lehman and realized that was not a good idea."

The gap between the interest rates Greece, Portugal and Spain must pay investors to borrow for 10 years and the rate charged to Germany rose yesterday to the widest since before they adopted the euro and credit-default swaps on Ireland hit a record. The differential between Austrian and German yields widened to a record today as concern intensified about Austria's exposure to eastern European banks.

"Austria is on the hook for so much money that essentially if they don't get paid by eastern Europe they'll go bust," Marc Faber, managing director of Marc Faber Ltd., said in a Bloomberg Television interview. "So the European Union basically has to help Austria one way or the other."

Greek credit-default swaps, at 270 points on Feb. 16, show a 4.5 percent chance that the country will default in the next 12 months, according to ING Bank NV.

No-Bailout Rule

Eddington Capital's Allen, who runs a fund of hedge funds, says the market currently "vastly underestimates" the risks and expects credit-default swaps for Greece, Italy, Spain and Portugal to double in the next 12 months.

Any state-funded rescues may nevertheless meet with opposition from the ECB, which has repeatedly said the Maastricht Treaty forbids bailouts.

"The no-bailout rule is an important pillar on which the European Union was founded," ECB Executive Board member Juergen Stark, who helped draw up the fiscal rules underpinning the euro, said Jan. 15. Today he urged countries with large deficits to take measures to rein them in.

At the same time, the treaty also says that EU nations can grant financial assistance to a member state if a country is "threatened with severe difficulties" caused by "exceptional occurrences beyond its control."

"The member countries are working hard on a 'pre-emptive de facto bailout' to prevent the test of the "no bailout" clause," said Juergen Michels, an economist at Citigroup Inc. in London.

Single Treasury

Part of the problem policy makers now face stems from the fact the currency union does not have a single treasury and relies on the Stability and Growth Pact, which has been breached in the past, to keep budgets in check. Billionaire investor George Soros said yesterday the region's economy must confront the problem posed by the lack of a Europe-wide finance ministry.

For now, finance officials say that market concerns are not justified. ECB President Jean-Claude Trichet said in Rome on Feb. 14 he's confident countries will work toward sustainable public finances.

Greek Finance Minister Ioannis Papathanasiou said three days earlier the extra interest rates on his country's debt were unjustified. Spain's Deputy Finance Minister Carlos Ocana categorically ruled out a default on Feb. 16, and the Irish Finance Ministry warned yesterday against drawing conclusions about public finances from the CDS market.

Steinbrueck's comments nevertheless suggest that views in Berlin are shifting as the financial crisis worsens.

"In reality the other states would have to rescue those running into difficulties," he said Feb. 16. Steinbrueck said that Ireland was in a "very difficult situation."

"There will have to be some kind of support package for some of the smaller economies to avoid the tension and speculation about breakup," said Ken Wattret, senior economist at BNP Paribas SA in London. "The bigger national governments will say this isn't our problem. But when push comes to shove, they might need to provide some kind of financial support."

To contact the reporter on this story: Emma Ross-Thomas in Madrid at erossthomas@bloomberg.net

-- bruno seminario

¿Opera Stanford en el Perú?

Billionaire's bank customers denied their deposits

By BEN FOX, Associated Press Writer Ben Fox, Associated Press Writer – 20 mins ago

ST. JOHN'S, Antigua – Panicky depositors were turned away from Stanford International Bank and some of its Latin American affiliates Wednesday, unable to withdraw their money after U.S. regulators accused Texas financier R. Allen Stanford of perpetrating an $8 billion fraud against his companies' investors.

Some customers arrived in Antigua by private jet and were driven up the lushly landscaped driveway of the bank's headquarters, only to be told that all assets have been frozen pending an investigation by Antiguan banking regulators.

"I don't know what to think. I have my life savings here," said Reinaldo Pinto Ramos, 48, a Venezuelan software firm owner who flew in by chartered plane from Caracas Wednesday with five other investors to check on their accounts. "We're waiting to see some light."

Banking regulators and politicians around the region are scrambling to contain the damage after the U.S. Securities and Exchange Commission filed civil fraud charges against the billionaire on Tuesday. Regional Director Rose Romero of the SEC's Fort Worth office called it a "fraud of shocking magnitude that has spread its tentacles throughout the world."

Stanford, 58, is a larger-than-life figure in the Caribbean, using his personal fortune — estimated at $2.2 billion by Forbes magazine — to bankroll public works and sports teams. He also is a major player in U.S. politics, personally donating nearly a million dollars, mostly to Democrats. At 6-foot-4 and 240 pounds, he towered over House Speaker Nancy Pelosi while giving her a warm hug at the Democratic National Convention last year.

He owns a home in the U.S. Virgin Islands, and operates businesses from Houston to Miami and Switzerland to Antigua, where the government knighted him in 2006 in recognition of his economic influence and charity work.

U.S. regulators have accused Stanford, two other executives and three of their companies of luring investors with promises of "improbable and unsubstantiated" high returns on certificates of deposit and other investments.

Many details about the alleged fraud remain unclear, but the SEC alleges a pattern of secrecy, including a failure to disclose the bank's exposure to losses in money manager Bernard Madoff's alleged Ponzi scheme.

The SEC said no one but Stanford and James M. Davis of Baldwyn, Miss., the Antigua-based bank's chief financial officer, know where most of depositors' cash is invested, and both men have failed to cooperate with investigators. "Approximately 90 percent of SIB's claimed investment portfolio resides in a 'black box' shielded from any independent oversight," the SEC said in its complaint.

Stanford wasn't talking Wednesday and a company Web site directed inquiries to the SEC. But in an e-mail to his employees last week, the billionaire said his company was cooperating with the probe, and vowed to "fight with every breath to continue to uphold our good name and continue the legacy we have built together."

A federal judge appointed a receiver to identify and protect Stanford's assets worldwide, including about $8 billion managed by the bank, which has affiliates in Mexico, Panama, Colombia, Ecuador, Peru and Venezuela.

Also frozen were assets of Houston-based Stanford Capital Management and Stanford Group Company, which has 29 brokerage offices around the U.S.

"The fallout threatens catastrophic and immediate consequences" for the twin-island nation of Antigua and Barbuda, said Prime Minister Baldwin Spencer. It also could rattle the economies of smaller nations where Stanford's companies have had outsized influence.

SEC spokesman John Nester said the agency does not know where Stanford is. James Sullivan, the U.S. marshal for the Virgin Islands, said agents are monitoring his "extensive holdings" in St. Croix, including a boat he sometimes he docks there, but could not say whether he is in the territory. He does not currently face any charges requiring his presence in court.

"As of right now, all we are doing is an ongoing investigation to monitor his holdings, for lack of better term, and we are not actively pursuing him," Sullivan told The Associated Press.

Some U.S. lawmakers quickly announced they would donate Stanford's campaign contributions to charity.

The Stanford Financial Group, through its political action committee and employees, has contributed $2.4 million to political candidates, parties and committees in the U.S. since 1989, with nearly two-thirds going to Democrats, according to the Center for Responsive Politics, a group that tracks campaign spending.

Most of that cash flowed during the 2002 election cycle, when Congress was debating a financial services antifraud bill that would have linked the databases of state and federal banking, securities and insurance regulators. The bill ultimately died in the Senate, where the biggest recipients have been Sen. Bill Nelson, D-Fla. ($45,900); Sen. John McCain, R-Ariz. ($28,150); Sen. Chris Dodd, D-Conn. ($27,500); and Sen. John Cornyn, R-Texas ($19,700). Rep. Pete Sessions, R-Texas also received $41,375.

Stanford and his wife Susan also donated $931,100 of their own money, with 78 percent going to Democrats, including $4,600 to President Barack Obama's presidential campaign last May 31. Records show $2,300 of that was returned on the same day.

Governments across Latin America and the Caribbean took a variety of actions Wednesday to protect investors who'd deposited money with Stanford-linked institutions.

Colombia and Ecuador suspended the activities of Stanford's local brokerages Wednesday, and Panamanian regulators occupied Stanford bank branches hit by a run on deposits, which they described as an isolated "consequence of decisions adopted by foreign authorities." Assets at the bank's four Panama branches, which reportedly held $200 million in deposits at year's end, are held largely in liquid, fixed-income investments that can more easily be converted into cash to cover deposits if necessary, the bank said.

In Venezuela, banking regulator Edgar Hernandez said the government was considering a request for help from Stanford Bank SA in Caracas after a $26.5 million run on deposits removed about 12 percent of its holdings.

"We suggested an open intervention" by the government, including the possibility of the government or a state-run bank depositing funds to back deposits, Hugo Faria, one of the bank's directors, told The Associated Press.

In Mexico, where the Stanford Fondos unit manages about $50 million for some 3,400 clients, a note posted on a shuttered office door in the capital's wealthy Polanco neighborhood announced that all accounts "are temporarily frozen."

"We don't have any other information at this time, you will be contacted in the future with more details," the note said.

Karina Klinckwort, 38, had rushed to the office Wednesday: "Everything I have is with them, everything that my husband, may he rest in peace, invested is with them."

The Stanford-controlled Bank of Antigua was not named in the complaint, but many Antiguans lined up outside nevertheless to try to get their money. Some of these working-class depositors clutched portable radios to listen to financial news.

"People have to come to get their money," said electrician Rasta Kente.

But panicking will only make things worse, regional regulators warned.

"If individuals persist in rushing to the bank in a panic they will precipitate the very situation that we are all trying to avoid," said K. Dwight Venner, governor of the Eastern Caribbean Central Bank.

___

Associated Press Writers Anika Kentish in St. John's, Antigua; Jim Abrams in Washington, D.C.; Jeff Kummer in Dallas; Frank Bajak in Bogota; Jeanneth Valdivieso in Olga Rodriguez in Mexico City; and Fabiola Sanchez in Caracas, Venezuela contributed to this report.

--

http://www.betaggarcian.blogspot.com/

18 feb 2009

Fwd: Macroperu FMI Opus: GDP en Ukrania desiende en enero 20 por ciento.

Ukraine GDP Down 20% Year on Year In January

Industrial output fell in January for the sixth month in a row, with a 16.1 percent decline between January and December 2008. This was the biggest decrease since January 1994, when there was an 18.6 percent drop. Industrial production in January was 34.1 percent down on January 2008. The year-on-year decline in construction also increased ten-fold, hitting 57.6 percent, Lytvytsky said.

"At the start of last year there was one sector in recession - construction. All the rest were in positive territory. Now only one economic sector is growing - agriculture - with growth of 0.5 percent, within the margin of error. All the other basic industries, which account for about 80 percent of GDP, are contracting." Valeriy Lytvytsky

Unfortunately this may well be the last month for which I can do this kind of calculation and comparison, since the State Statistics Committee will not be publishing monthly GDP results (as in the past), starting this January and (ironically) as a result of the move to harmonise Ukraine methodology with international-standard, quarterly reporting. I say ironically, since in this case we will be trading short term insight for longer term precision. However, the office will continue publishing monthly results for individual economic sectors like agriculture, industry, construction and transportation, so we maywell be able to invent some kind of "proxy", just to keep an eye on what is happening in more or less real time.m

Etiquetas: 2009, CONSTRUCCION, CONSUMO, CRISIS, DEFLACION, feb09, INDUSTRIAL, PRODUCCION, RECESION, UKRANIA

GREENSPAN: nacionalisation banque

Greenspan backs bank nationalisation

By Krishna Guha and Edward Luce in Washington

Published: February 18 2009 00:06 | Last updated: February 18 2009 00:06

The US government may have to nationalise some banks on a temporary

basis to fix the financial system and restore the flow of credit, Alan

Greenspan, the former Federal Reserve chairman, has told the Financial

Times.

In an interview, Mr Greenspan, who for decades was regarded as the high

priest of laisser-faire capitalism, said nationalisation could be the

least bad option left for policymakers.

PBI de Taiwan desciende en el IV trimestre 8 por ciento.

Taiwan falls into recession

By Robin Kwong in Taipei

Published: February 18 2009 09:24 Last updated: February 18 2009 19:23

Taiwan has tumbled into recession, suffering a record annual fall in output at the end of last year to become east Asia's worst-performing economy.

Official data yon Wednesday showed Taiwan's gross domestic product shrank 8.36 per cent year-on-year in the last quarter of 2008, a bigger drop than analysts had expected and that underscored the exposure of Asian exporters to the slump in world demand.

The figures spurred the Taiwanese central bank to make an unexpected 0.25 percentage point cut in interest rates, bringing its key interest rate to a record low of 1.25 per cent. The economy has contracted for two straight quarters, meeting a common definition of recession.

Yen Tzung-ta, the bank's top economist, said that "by cutting rates, we want to send a signal: the central bank will maintain a loose money policy".

Taiwan's woes spell further gloom for other economies in the region, particularly that of China, where Taiwanese manufacturers have shifted much of their output in recent years and where many of the island's manufactured electronics parts are shipped for final assembly before being sold to consumers in the west.

According to the International Labour Organisation, Asia will see the number of jobless people rise by up to 23.3m in 2009, three times more than the estimate of 7.2m last month as the region reels from the recession in the world's richest countries.

Taiwanese officials said that its economy, Asia's sixth biggest, would deteriorate further throughout the first half of this year. They forecast a contraction of nearly 3 per cent in 2009 after earlier projecting growth of more than 2 per cent.

Exports are expected to drop by a fifth this year, with consumer prices projected to fall sharply too.

"There is little hope of returning to positive economic growth until the fourth quarter of this year," said Tsai Hung-kun, of the national statistics agency.

While suggesting that exports would begin to rebound at the year end, he said the government had underestimated the degree to which exports suffered when it predicted three months ago that the economy would grow by more than 2 per cent this year.

"Taiwan is particularly affected by the global economic climate because of [its] concentration in export products," the central bank said.

The latest figures heap pressure on President Ma Ying-jeou, who was elected on a platform of economic growth last year but whose popularity has fallen.

The government has already announced a T$500bn (US$14.4bn), two-year stimulus package, which includes infrastructure projects, measures to boost employment and hand-outs of T$85bn in consumer vouchers.

Mr Tsai said the government spending would boost GDP by 2.77 per cent this year. But economists doubted the extent to which the measures would help the economy and said Taiwan remained vulnerable to weak global demand.

"[The measures] will help but not significantly because they are not of a big enough scale," said Cheng Cheng-mount, chief economist at Citibank in Taipei. "There is still a lot of room for further government spending, as Taiwan's debt-to-GDP ratio is only around 30 per cent."

http://www.betaggarcian.blogspot.com/

EL PBI de Singapur desciende 12,5 por ciento

Singapore's GDP slumps 12.5 percent

(CNN) -- In a further indication of the weakening Asian economy, Singapore on Friday said GDP had declined by 12.5 percent in real terms in the fourth quarter of 2008 and revised downwards its growth estimates for 2009.

Blaming the global economic crisis, Singapore's Ministry of Trade and Industry (MTI) warned that the island state's economy would grow no more than 1 percent and could shrink by up to 2 percent in 2009. In November it predicted growth of -1 percent to 2 percent.

"Since November, analysts have shaded down their growth forecast for the US, Europe and Japan by about one percentage point," the ministry said in a statement.

"The growth outlook for the regional economies has also deteriorated, with more economies now expected to register negative or flat growth next year."

In 2008, Singapore's economy grew by an estimated 1.5 percent, falling short of forecasts of 2.5 percent and well down on 2007's 7.7 percent growth.

The ministry said manufacturing would be weighed down by falling demand in developed economies and predicted a sharp slowdown in financial services caused by weak financial markets and credit growth.

All sectors of Singapore's economy dependent on the movement of goods and services in the region would be affected it said.ENTREVISTAS TV CRISIS GLOBAL

Etiquetas

- 1 MAYO

- 2

- 2002

- 2007

- 2008

- 2009

- 2010

- 2011

- 2012

- 2013

- 2014

- 2015

- 2016

- 2o11

- 2OO9

- a

- abr2015

- abril09

- abril10

- acc

- actualidadecono

- AFP

- AFPS

- AFRICA

- Ago11

- AGOS

- AGOST10

- agost12

- AGOSTO2008

- AGOSTO2009

- agosto2015

- AGRO

- AGROEXPORTACION

- AIG

- AL

- ALAGROEXPORTACION

- ALEMANIA

- ALIMENTOS

- amazonia

- AMERICALATINA

- ANDAHUAYLAS

- APEC

- ARCH MES

- ARGENTINA

- asarco

- ASIA

- ATTAC

- australia

- AUTOMOVIL

- AVAAZ

- b

- BAILOUT

- baltic

- BANCOS

- BC

- BCE

- BCRP

- benassy

- benedetti

- BERNANKE

- bernis

- BIELORUSIA

- BIS

- blanchard

- BOE

- BOJ

- BOLIVIA

- BOLSA

- BONUS

- BRASIL

- BRIC

- BUBBLE

- bundesbank

- C

- c rec

- CAFE

- CAMBIOCLIMATICO

- CAMERICAS

- CAN

- CANADA

- CANCION

- CAPITALISMO

- castro

- CDO

- cepij

- CHAVEZ

- cheque

- CHILE

- chimerica

- CHINA

- CHRYSLER

- CICLO

- CIE

- ciencia

- CIP

- COBRE

- COLOMBIA

- COMERCIO

- commodities

- COMPUTO

- CONSTRUCCION

- CONSUMO

- CONTAGIO

- control

- COPENHAGUE

- CORRUPCION

- coursera

- CRECIMIENTO

- CREDITO

- CRISIS

- CUBA

- CUMBREALCUE

- CUMBREALCUSA

- davos

- DEC08

- DEC11

- dec12

- DEC13

- dec15

- DEFICIT

- DEFLACION

- demanda

- DEPRESION

- DERIVADOS

- DEUDA

- developpement

- DIC09

- DIC10

- dic12

- DICIEMBRE

- do

- DOLAR

- doubledip

- dsk

- dubai

- duracion

- ec

- ecologo

- ECONOMIA

- ECUADOR

- EDUCA

- efectos

- EMPLEO

- EN11

- en16

- EN2016

- encuesta

- ene016

- energia

- ENERO

- ENERO09

- enero10

- EST

- eu

- EURO

- expansion

- EXPORTACION

- f

- fannie

- feb09

- feb10

- feb13

- feb15

- FED

- filo

- fin

- FINANZAS

- FINLANDIA

- fisica

- flu

- FMI

- FONDOS

- fr

- FRANCE

- frankfurt

- frontrunning

- fukushima

- G20

- G7

- GAS

- geab

- GEITHNER

- gini

- GLO

- global

- GM

- GONZALO GARCIA

- grece

- GREENSPAN

- GRENOBLE

- gripeporcina

- grupo mexico

- HAITI

- hambre

- HEDGE FUNDS

- HIPOTECA

- hist

- HOLLANDE

- HONDURAS

- IMPORTACION

- IMPUESTOS

- INDE

- INDIGNADOS

- INDUSTRIAL

- INFLACION

- INFORMALIDAD

- INFRAESTRUCTURA

- INGENIERIA

- INGENIEROS

- innova

- INTEGRACION

- INTERNACIONAL

- INVERSION

- IRAN

- IRLANDA

- ISLANDIA

- ismea

- ITALIA

- IZQ

- JAPON

- JUL11

- JULIO08

- JULIO09

- JULIO15

- JUN09

- jun10

- jun11

- JUN12

- jun13

- jun15

- JUNIO08

- keynes

- KRUGMAN

- lagarde

- LAREPUBLICA

- leap

- leverage

- liquidez

- LITIO

- lme

- LR

- macro

- MACROECONOMICS

- madera

- MADOFF

- MAMBIENTE

- MANGO

- MARS09

- mars10

- marx

- matematicas

- MATERIASPRIMAS

- MATUK

- MAY09

- MAY11

- MAY12

- MAY13

- may15

- may2015

- MAYO

- MBS

- me

- mef

- MERKEL

- METALES

- MEXICO

- miga

- MIGRA

- MINERIA

- MODELES

- MONDE

- MONEDA

- mourey

- MUJICA

- MUNDO

- musica clasica

- NACIONALIZACION

- neural

- niño

- nobel

- NOTASEMANAL

- NOV08

- nov09

- nov10

- NOV11

- NOV12

- nov15

- nuclear

- OBAMA

- OCDE

- oct09

- oct10

- OCT11

- oct12

- OCTUBRE08

- OFCE

- OIT

- OMC

- ORO

- paita

- PANAMA

- PAPA

- PARADIS

- PARAGUAY

- PAULSON

- pbi

- pe

- PEÑAFLOR

- PERU

- pesca

- PETROLEO

- piketty

- PLAN

- PMI

- POBLA

- POBREZA

- POL

- POLITICA

- porter

- portugal

- postcrisis

- PPT_CRISIS

- PRODUCCION

- PRODUCTIVIDAD

- profits

- prog

- PROTECCION

- QUIEBRA

- r

- RECESION

- REGULACION

- REMESAS

- REPEC

- REPRISE

- REPSOL

- RESERVAS

- RETAIL

- RGE

- RIESGOPAIS

- RMBS

- ROBOTICA

- RODRIK

- ROUBINI

- RUSIA

- SALARIOS

- SARKO

- school paris

- sep11

- SEP15

- SEQUIA

- SERVICIOS

- set09

- set10

- set11

- set12

- SET15

- SETIEMBRE08

- SINGAPUR

- SIRIA

- sismo

- soros

- southern

- SPAIN

- STANFORD

- STIGLITZ

- SUBPRIMES

- SUISSE

- SYRIZA

- TAIWAN

- TARIFAS

- TAS

- TCAMBIO

- TECNOLOGIA

- TERRITORIO

- TEXTIL

- TINTERES

- TLC

- TPP

- trabajo

- trentin

- TRICHET

- TROIKA

- tsunami

- TURISMO

- TV

- UBS

- UE

- UK

- UKRANIA

- UNASUR

- URUGUAY

- USA

- v

- VENEZUELA

- VIDEO

- vivienda

- WALL STREET

- WS

- wsj

- YEN

- young

- YUAN

- Zbasura

- zerohedge

Peru:crisis impacto regional arequipa,raul mauro

Temas CRISIS FINANCIERA GLOBAL

claves para pensar la crisis

-Tipo de cambio

- DIARIOS DE HOY

PRESS CLIPPINGS-RECORTES PRENSA-PRESSE..

canciones de GRACIAS A LA VIDA !

ETIQUETAS alfabetico

- 1 MAYO

- 2

- 2002

- 2007

- 2008

- 2009

- 2010

- 2011

- 2012

- 2013

- 2014

- 2015

- 2016

- 2o11

- 2OO9

- a

- abr2015

- abril09

- abril10

- acc

- actualidadecono

- AFP

- AFPS

- AFRICA

- Ago11

- AGOS

- AGOST10

- agost12

- AGOSTO2008

- AGOSTO2009

- agosto2015

- AGRO

- AGROEXPORTACION

- AIG

- AL

- ALAGROEXPORTACION

- ALEMANIA

- ALIMENTOS

- amazonia

- AMERICALATINA

- ANDAHUAYLAS

- APEC

- ARCH MES

- ARGENTINA

- asarco

- ASIA

- ATTAC

- australia

- AUTOMOVIL

- AVAAZ

- b

- BAILOUT

- baltic

- BANCOS

- BC

- BCE

- BCRP

- benassy

- benedetti

- BERNANKE

- bernis

- BIELORUSIA

- BIS

- blanchard

- BOE

- BOJ

- BOLIVIA

- BOLSA

- BONUS

- BRASIL

- BRIC

- BUBBLE

- bundesbank

- C

- c rec

- CAFE

- CAMBIOCLIMATICO

- CAMERICAS

- CAN

- CANADA

- CANCION

- CAPITALISMO

- castro

- CDO

- cepij

- CHAVEZ

- cheque

- CHILE

- chimerica

- CHINA

- CHRYSLER

- CICLO

- CIE

- ciencia

- CIP

- COBRE

- COLOMBIA

- COMERCIO

- commodities

- COMPUTO

- CONSTRUCCION

- CONSUMO

- CONTAGIO

- control

- COPENHAGUE

- CORRUPCION

- coursera

- CRECIMIENTO

- CREDITO

- CRISIS

- CUBA

- CUMBREALCUE

- CUMBREALCUSA

- davos

- DEC08

- DEC11

- dec12

- DEC13

- dec15

- DEFICIT

- DEFLACION

- demanda

- DEPRESION

- DERIVADOS

- DEUDA

- developpement

- DIC09

- DIC10

- dic12

- DICIEMBRE

- do

- DOLAR

- doubledip

- dsk

- dubai

- duracion

- ec

- ecologo

- ECONOMIA

- ECUADOR

- EDUCA

- efectos

- EMPLEO

- EN11

- en16

- EN2016

- encuesta

- ene016

- energia

- ENERO

- ENERO09

- enero10

- EST

- eu

- EURO

- expansion

- EXPORTACION

- f

- fannie

- feb09

- feb10

- feb13

- feb15

- FED

- filo

- fin

- FINANZAS

- FINLANDIA

- fisica

- flu

- FMI

- FONDOS

- fr

- FRANCE

- frankfurt

- frontrunning

- fukushima

- G20

- G7

- GAS

- geab

- GEITHNER

- gini

- GLO

- global

- GM

- GONZALO GARCIA

- grece

- GREENSPAN

- GRENOBLE

- gripeporcina

- grupo mexico

- HAITI

- hambre

- HEDGE FUNDS

- HIPOTECA

- hist

- HOLLANDE

- HONDURAS

- IMPORTACION

- IMPUESTOS

- INDE

- INDIGNADOS

- INDUSTRIAL

- INFLACION

- INFORMALIDAD

- INFRAESTRUCTURA

- INGENIERIA

- INGENIEROS

- innova

- INTEGRACION

- INTERNACIONAL

- INVERSION

- IRAN

- IRLANDA

- ISLANDIA

- ismea

- ITALIA

- IZQ

- JAPON

- JUL11

- JULIO08

- JULIO09

- JULIO15

- JUN09

- jun10

- jun11

- JUN12

- jun13

- jun15

- JUNIO08

- keynes

- KRUGMAN

- lagarde

- LAREPUBLICA

- leap

- leverage

- liquidez

- LITIO

- lme

- LR

- macro

- MACROECONOMICS

- madera

- MADOFF

- MAMBIENTE

- MANGO

- MARS09

- mars10

- marx

- matematicas

- MATERIASPRIMAS

- MATUK

- MAY09

- MAY11

- MAY12

- MAY13

- may15

- may2015

- MAYO

- MBS

- me

- mef

- MERKEL

- METALES

- MEXICO

- miga

- MIGRA

- MINERIA

- MODELES

- MONDE

- MONEDA

- mourey

- MUJICA

- MUNDO

- musica clasica

- NACIONALIZACION

- neural

- niño

- nobel

- NOTASEMANAL

- NOV08

- nov09

- nov10

- NOV11

- NOV12

- nov15

- nuclear

- OBAMA

- OCDE

- oct09

- oct10

- OCT11

- oct12

- OCTUBRE08

- OFCE

- OIT

- OMC

- ORO

- paita

- PANAMA

- PAPA

- PARADIS

- PARAGUAY

- PAULSON

- pbi

- pe

- PEÑAFLOR

- PERU

- pesca

- PETROLEO

- piketty

- PLAN

- PMI

- POBLA

- POBREZA

- POL

- POLITICA

- porter

- portugal

- postcrisis

- PPT_CRISIS

- PRODUCCION

- PRODUCTIVIDAD

- profits

- prog

- PROTECCION

- QUIEBRA

- r

- RECESION

- REGULACION

- REMESAS

- REPEC

- REPRISE

- REPSOL

- RESERVAS

- RETAIL

- RGE

- RIESGOPAIS

- RMBS

- ROBOTICA

- RODRIK

- ROUBINI

- RUSIA

- SALARIOS

- SARKO

- school paris

- sep11

- SEP15

- SEQUIA

- SERVICIOS

- set09

- set10

- set11

- set12

- SET15

- SETIEMBRE08

- SINGAPUR

- SIRIA

- sismo

- soros

- southern

- SPAIN

- STANFORD

- STIGLITZ

- SUBPRIMES

- SUISSE

- SYRIZA

- TAIWAN

- TARIFAS

- TAS

- TCAMBIO

- TECNOLOGIA

- TERRITORIO

- TEXTIL

- TINTERES

- TLC

- TPP

- trabajo

- trentin

- TRICHET

- TROIKA

- tsunami

- TURISMO

- TV

- UBS

- UE

- UK

- UKRANIA

- UNASUR

- URUGUAY

- USA

- v

- VENEZUELA

- VIDEO

- vivienda

- WALL STREET

- WS

- wsj

- YEN

- young

- YUAN

- Zbasura

- zerohedge

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/spot-copper-30d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/zinc-d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/lead-d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/spot-nickel-30d.gif)