From: The Washington Post <newsletters@email.washingtonpost.com>

Date: 2011/9/9

Subject: Politics News & Analysis: Obama's speech is the opening round of a White House offensive

To: ggarcianunez@gmail.com

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2008-2009-2010-2011-Double dip-2012-Depresion 2013,soft reprise 2014,2015,2016, 2017,2018

![[Most Recent Quotes from www.kitco.com]](http://www.weblinks247.com/indexes/gfms.gif) |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Etiquetas: 2012, CRISIS, DEFICIT, FINANZAS, FRANCE, global, HOLLANDE, MACROECONOMICS, MAY12, REGULACION, WALL STREET

|

"Even today, Japan is having trouble climbing out of its cement pit. At its high, in the mid-1990s, infrastructure spending accounted for 6 percent of its gross domestic product, double what the United States allocated for infrastructure in the '90s and still higher than what politicians are considering spending today. In estimates of national debt, the world's second-largest national economy is near the top of the list, perched between Lebanon and Jamaica. Last year, Japan's public debt was far greater than the size of its economy, a burden that makes its demographic challenges more difficult to address".

Across Latin America's largest economy, record prices for the country's commodities and surging foreign fund inflows – what the International Monetary Fund calls "favourable tailwinds" – are driving a historic boom. Property prices are soaring, consumer credit is booming and bank profits swelling. But there are growing concerns over whether Brazil is becoming addicted to this windfall of easy money. Increasingly, there are fears that Brazil is heading for a bubble.

"Germany started the second quarter of 2012 with its worst manufacturing performance for almost three years, as another month of weaker order inflows finally brought production levels back into contraction. With backlogs of work failing to support output volumes in April, manufacturers cut their staffing numbers for the first time since March 2010."The investment goods sector was at the forefront of the downturn in April, as jitters about global economic conditions meant clients in export markets sought to delay large scale spending decisions. Investment goods producers saw export orders fall at the steepest pace in nearly three years, and in turn job losses were the most pronounced of the three main market groups monitored by the survey.

"April proved to be another difficult month for Greek manufacturers, with latest data again showing steep contractions across a number of key variables measured by the survey. "In line with recent reports, the issues facing manufacturers – and the Greek economy as a whole – remain deep rooted. Panelists again noted problems in accessing working capital and a culture of cash payments, implying that credit lines remain either closed or that agreements will come with restrictive terms."At present, it remains hard to see how these issues can be solved suggesting that the manufacturing sector is set for continued struggle in the months ahead."

Gerardo Saravia(http://www.revistaideele.com/node/570)

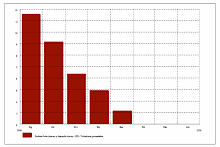

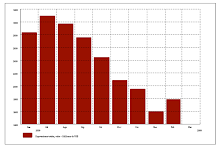

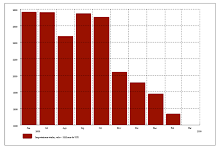

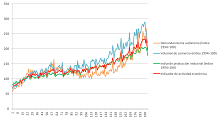

* Los gráficos han sido tomados del economista Waldo Mendoza.

De tanto hablar del milagro económico peruano, finalmente se ha concretado, pero no exactamente en los términos de blindaje ante la crisis con el que el Presidente encandiló nuestros oídos a comienzos de este año.

Ni siquiera (a pesar de los pronósticos oficiales) podremos, en el epílogo de la crisis mundial, contar a nuestro país entre los que mejor performance lograron. A estas alturas, el cuento de “Perú país refugio de capitales” mejor ni contarlo.

Con la caída de diez a cero puntos en el PBI, el milagro anunciado se convirtió en la pesadilla del soñador. Estamos entre los países que han sufrido la caída más brutal de su producción en lo que va del año. ¿De la región? Qué va: del mundo.

Bajo cero

Sin duda, a fin de año no faltarán los titulares con cuadros comparativos que anunciarán, festivos, que hemos crecido más que nuestros vecinos y lejanos. En esas condiciones, habrá que aclarar la diferencia entre un país que crecía a 4% y ha caído a menos 2% y uno que crecía a 9% y ha caído a cero o uno.

El terremoto de 8 puntos abajo en escala García no va a significar una hecatombe económica como la de los años 1980, pero sí revela la vulnerabilidad de nuestra economía. No era tan fuerte como nos habían contado. O, lo que es peor, no hemos sabido administrar nuestras fuerzas.

No existe acá afán alguno de endilgarle al Gobierno culpas externas. Está claro que la crisis la importamos, y que no existía maniobra macro ni micro capaz de evitar que se presentara en el país. El pecado consistió precisamente en pretender negar lo evidente, no hacer nada o hacerlo a destiempo.

¿El resultado?: una caída brutal del PBI que ha llevado al aparato productivo a la recesión desde hace dos trimestres. Sin embargo, el Gobierno persiste en el error de negarlo.

|

El impacto económico de la crisis en el país se expresa, según el economista Bruno Seminario, por tres canales: inversión minera, manufactura y servicios.

“Esta crisis ha afectado la rentabilidad de la minería. Los flujos de inversión directa extranjera en el último trimestre del año pasado pasaron de 7.000 millones de dólares a cero. Luego se recuperaron un poco. Los nuevos proyectos de inversión se han cortado.”

La industria textil ha caído en un 50%, como la producción agroindustrial: no han podido vender sus productos al exterior y tampoco los pudieron colocar acá. Lo mismo ha ocurrido en otras ramas. Los economistas llaman a esto “reducción de inventarios”. Es decir, las industrias acumularon una serie de productos que no llegaron a vender y han tenido que reducir sus tasas de producción.

En el sector construcción construcción, una catapulta económica, se ha registrado un incremento mínimo de la inversión pública (ésta representa, en total, un 10% del PBI) y un decrecimiento de la privada, que es la principal en el sector.

Lamentablemente, esta información no son quejas de llorones y pesimistas como zarandeó el despacho gubernamental a inicios de año. Son cifras oficiales, obtenidas de fuentes oficiales, confundidas y clandestinas entre los encriptados informes del BCR y el INEI.

|

A pesar de la cáustica ineptitud de nuestros conductores económicos, hay aspectos de nuestra economía que se mantienen fuertes debido al abultado crecimiento de años anteriores. El sistema bancario, por ejemplo. Las últimas grandes crisis nacionales dejaron como saldo muchos bancos muertos y los demás heridos o absorbidos. En este caso se han mantenido indemnes.

El sector Comercio sigue siendo un misterio. De acuerdo con la rebúsqueda oficial, se aprecia un incremento, lo que parecería contradictorio con esta etapa de crisis. No es lógico encontrar que toda la industria caiga de porrazo y que el sector comercial no solo se mantenga sino que crezca.

Bruno Seminario cree encontrar la razón en el cambio de metodología: “En el sector comercial no se sabe bien lo que está pasando; si se midiera con la metodología antigua, estaría cayendo en 7%. El sector está compuesto tanto por el grupo de tiendas pequeñas y bodegas como por los grandes centros comerciales. Ahora las encuestas captan solo las ventas de las empresas grandes. El problema es que ahora estas grandes tiendas se están expandiendo a sectores donde antes estaban las pequeñas. Por ejemplo, si alguien antes compraba en tiendas chicas, ahora lo hace en las grandes, y las estadísticas muestran ese incremento como si fuera una expansión general del comercio”.

Bien dicen que existe la verdad, la mentira y las estadísticas.

Ensayo sobre la ceguera

Ante esta recatafila de malas noticias, es inevitable preguntar qué se hizo mal. El economista Waldo Mendoza, aquel que vaticinara crecimiento cero para este año y que se ganó a pulso la ira oficial, intenta dibujarnos el asunto de una manera muy poco auspiciosa para quienes pensaban que García había aprendido la lección de no meterse en temas para los que está negado.

“Pese a todas las fortalezas que decíamos tener, el comportamiento de la economía ha sido muy similar al de 1997-1998 (la última gran crisis). En 1997 la economía crecía 7%, y en 1998 nos caímos 1%. Este año crecíamos al 10% y probablemente llegaremos a cero. La responsabilidad básica es de la política macroeconómica. Debe ser la primera vez en la historia que contábamos con todos los recursos para enfrentar la crisis. En 1998 no teníamos divisas; esta vez sí, y muchas. En 1998 los bancos estaban frágiles: un pequeño sacudón los tumbaba y de hecho los tumbó; esta vez están sólidos. En 1998 teníamos déficit fiscal y no podíamos hacer una política fiscal contracíclica; esta vez sí la tenemos. Todo esto nos hace pensar que hay algo que no hemos hecho bien.”

Otra oportunidad perdida. No estábamos curados.

|

La búsqueda de culpables no es muy productiva en lo inmediato, pero debería ser aleccionadora. Veamos cómo funciona la cosa: la política macroeconómica es responsabilidad del Ministerio de Economía y del BCR. Cuando se da un episodio de crisis, estas instituciones son las encargadas de tomar las medidas para contrarrestarlo o, al menos, amortiguarlo.

Como impedir la crisis era imposible, lo que sí se podía era morigerar sus efectos. La receta para estos casos no es un enigma egipcio: se trata, más bien, de una fórmula universal. El BCR baja los intereses y el Ministerio de Economía expande el gasto fiscal. A eso también se le conoce como una política contracíclica: cuando el mercado se contrae, el Estado expande su inversión y baja los intereses; cuando el mercado se expande, el Estado contrae el gasto.

A las dos instituciones se les critica que no hayan tomado las medidas a tiempo.

En el caso del BCR hay opiniones encontradas. Si bien se le achaca haber bajado los encajes y los intereses cuando la crisis ya era muy profunda, Seminario sostiene que hizo bien en esperar que se estabilizara la situación del quebrado Lehman Brothers, para que la medida tuviera efecto en un mejor terreno.

En lo que sí todos coinciden es en la parsimonia con la que actuó el Ministerio de Economía. Rigurosamente errática. Cuando la crisis era inminente y todos vaticinaban contracción mundial, acá seguíamos festejando nuestro inflamado PBI. Cuando la mayoría de gobiernos del mundo decidieron hacer una política fiscal expansiva, aquí Valdivieso —entonces ministro de Economía— redujo inexplicablemente el gasto fiscal. Cuando la crisis nos golpeó en la cara a inicios de año, se decía que creceríamos 6,5%. Al final terminaron despidiendo al Mago Valdivieso y el Puma Carranza reingresó a la cancha, pero quiso meter los goles a último minuto, cuando ya perdíamos por goleada. ¿Demasiado boys estos chicagos? ¿O le hacían demasiado caso al capitán del equipo?

Waldo Mendoza no puede entender cómo gente capacitada pudo cometer yerros tan grandes. “Tenemos un BCR con gente sofisticada; tenemos un Ministerio de Economía con gente sofisticada que se creyó el discurso gubernamental que estamos blindados si se dice que estamos blindados. ¿Para qué hacer algo?”.

Es difícil imaginar a nuestro Presidente tomando distancia de las grandes decisiones. Su notoria tendencia es más bien a meter la cuchara en todo, y no nos referimos a su fisonomía. Bueno, también.

El problema es que cuando el Presidente decía que la economía peruana estaba blindada y que íbamos a ser refugio del capital extranjero, era porque realmente se lo creía. Y el Gobierno actuó de acuerdo con esta peregrina idea.

Lo cierto es que este año, de lo único que fuimos refugio fue de dos ex ministros bolivianos acusados de violar derechos humanos, y de que la inversión extranjera se fue hasta nuevo aviso, más rápido que volando.

|

Un lector desavisado podrá advertir que no siente la crisis. Que la gente sigue comprando igual y que sigue llenando las tiendas. Y puede tener razón, lo que, sin embargo, no significa que la crisis no exista. La peculiaridad de esta crisis es que ha atacado directamente a la médula del aparato productivo pero no ha producido inflación.

Según Bruno Seminario, la crisis no se siente globalmente en el país porque los perjudicados están muy sectorizados: “Solo la gente que se ha quedado sin trabajo ha visto reducidos sus ingresos. No es como antes, cuando todos se quedaban sin ingresos porque o subía el tipo de cambio o subían todos los precios, producto de la inflación, y eso afectaba a todo el mundo. Ahora se afecta únicamente a una parte de la población, y eso determina cierta estabilidad en la demanda de servicios”. Sin embargo, si la crisis continúa y no nos recuperamos, ella seguirá afectando la cadena productiva y podría llegar a todos, ya que el Estado no tiene la capacidad de sostener indefinidamente el gasto fiscal que contenga la crisis.

Para ello hay dos cosas que debemos considerar: el desenvolvimiento de la crisis internacional, y… que estamos en recesión.

|

No se lo digas a nadie

Aunque el Gobierno lo ha querido negar en todos sus silencios, de acuerdo con la nomenclatura internacional, el Perú se encuentra en recesión desde principios de año. Es el único país que no ha querido admitirlo. Aquí también se presenta el truquito de las estadísticas.

Para que un país se declare en recesión debe haber tenido, en dos trimestres seguidos, un crecimiento por debajo de cero. El Gobierno argumenta que en el primer trimestre de este año crecimos 0,9% y, por lo tanto, no estamos en recesión. Pero así no se mide el PBI en este mundo. Existe una forma seria de medir el PBI, que se llama “medición estacionalizada”. Mejor que lo explique Waldo Mendoza:

“Por ejemplo, en agricultura la producción de papa en mayo y junio siempre será mayor que en agosto. Entonces, para tener una visión real de la producción se desestacionalizan las cifras, lo que implica usar determinadas formas económicas como las que utilizan los macroeconomistas. De esa manera se mide el PBI en todo el mundo desarrollado.

“Si uno mira las cifras desestacionalizadas en el Perú, descubre que estamos en recesión desde el último trimestre del año pasado, y no hay hasta ahora ningún documento oficial que lo reconozca. Claro: cuando uno reconoce que está enfermo, aplica las medidas correspondientes. Somos el único país que tiene vergüenza de admitir que está en recesión”.

Lo que suceda en adelante con nuestro país va a seguir dependiendo de cómo se esclarezca el panorama mundial. La buena noticia es que la crisis parece haber tocado fondo y la recuperación se empezará a notar en los próximos meses. El problema va a ser cuán lenta o rápida puede ser, como advierte Mendoza:

“Al parecer, las tasas desestacionalizadas del cuarto trimestre en los Estados Unidos, Japón y Alemania van a ser positivas. Casi todos coinciden en que la recuperación ya empieza, pero también en que esa recuperación va a ser lenta, por diversos motivos. En el caso norteamericano, porque su Gobierno, para salir de la crisis, se ha puesto a gastar como loco; por eso su déficit fiscal debe estar en 8 o 9% de su PBI. Como esa cifra es insostenible, los próximos años los norteamericanos van a buscar desaparecer ese déficit cobrando impuestos. No hay otro método. Entonces el consumo privado no va a poder reactivarse en ese país, como estábamos acostumbrados. En Europa va a ser lo mismo, y éstas son las locomotoras del mundo. Si Europa y los Estados Unidos van a tener un crecimiento modesto, ¿como podrá crecer China sostenidamente? Así como en la caída, en la recuperación también los efectos son lentos”.

Quizá sea mejor curarse en salud. Pero el Gobierno, a pesar de la elocuencia de los números, parece que no termina de curarse de entusiasmitis y ha decidido que ya no es necesario seguir expandiendo el gasto fiscal. En el último presupuesto más bien se observa una reducción para las regiones. El ex vicepresidente del BCR, Óscar Dancourt, observa que en un contexto negativo esta contracción podría ser bastante dañina:

“Hay actuar de manera preventiva, pero para eso necesitas un diagnóstico exacto, y no se sabe qué va a pasar con la economía mundial. El Ministro ha dicho que ya no se necesitarían más impulsos fiscales, pero la recesión se puede extender hasta el 2010. Y para eso hay que comprar un seguro, que consiste en seguir con una política fiscal expansiva. En cambio, si no se concreta, se cortan esos programas”.

El Gobierno apuesta todas sus fichas a una eminente recuperación de la economía, sin tener en cuenta lo larga y lenta que puede ser.

Como corolario de las infelices cifras que coronan la macroeconomía peruana, puede decirse que el consejo de oro lo tienen las abuelas: decir la verdad, aunque duela. Lo recomienda hasta el sentido común: el primer paso para combatir una enfermedad es reconocer que se la tiene.

El presidente García tenía en esta crisis económica la oportunidad de su vida para revindicarse como estadista; pero ha demostrado, una vez más, que la economía no es su fuerte.

A diferencia de los años 80, esta vez tenía todo a su favor. Pero nuevamente desaprovechó la oportunidad. El 0% de crecimiento que nos acecha este año y la caída en nueve puntos del PBI hablan lindo de un Presidente peleado con los números y, hace mucho, también con la verdad.

|

------------------

“Contra el pesimismo

Previsión y perspectiva”,

Antonio Gramsci

QUO VADIS 2009?

Escribe: Gonzalo García Núñez, especial para

Le Monde Diplomatique Peru, Julio 2009

El gobierno ha destruido la trayectoria de muchos años consecutivos de crecimiento. Por eso las encuestas develan que su popularidad colisiona con las expectativas ciudadanas. De allí la importancia de saber lo que nos espera en el segundo semestre del 2009.

El decrecimiento mundial interanual será -1.4% durante el año responden las optimistas previsiones del FMI de DSK[1].

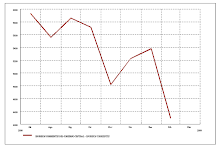

Perú bate un record de puenting (caída libre) del crecimiento: De tasas cercanas al 14% cae - 2% entre junio 2008 y mayo 2009, según datos de INEI.

Por eso, cero vaticinan los economistas más serios, ninguno más allá del 2% para el 2009.

Algunos voluntaristas creen que ya estamos en el “fondo del pozo” y que, en adelante, el mundo (y nosotros con el) rebotará hacia una tibia expansión en U o en L para el 2010.[2]

Otros presagios infieren que la trayectoria será mas bien una WWW, arranque y parada, stop and go, Roubini dixit.[3] También hay los ilusos. La fe del carbonero. Si se puede! [4]

Lo único que si se puede asegurar es que la crisis acabará. ¿Cuando y como? Nadie sabe con certeza.

CRISIS CON SANGRE ENTRA

En lo que hay un consenso es en el carácter inédito de la actual crisis:

1º Sensu contrario, la crisis partió del centro hacia la periferia. Pero hoy la recesión y la deflación son globales, salvo China e India, desacelerados.

Al fin de este primer semestre ambos cunden en los EE UU. La depresión se cierne negativamente sobre

Antes hizo trizas a la helada Islandia, le despoja de todo encanto a la neo liberalizada Irlanda, noquea a los Estados baltos, y en las antípodas, pela a los países de

La deprime no escatima a las plantas exportadoras del Japón industrial -aun cuando hay signos de esperanzada reactivación- i lentifica el crecimiento de los países-factoría del Asia.

(Casi) nadie se salva de los efectos de la crisis en este valle de lágrimas. Realmente mundial, la peor en años, nacida de las entrañas mismas del sistema global. Marx vive.[5]

2º Abate el comercio de mercancías y servicios. La tendencia a la constitución de un mercado mundial único encuentra sus límites. Pascal Lamy, secretario de

3º Profundiza la desvalorización de los mercados financieros, depreciando acciones, bonos, derivados, índices, instrumentos cambiarios y forex, las divisas claves y en especial, el dólar agujereado.[6]

El estallido de la “burbuja subprime” dejó, además, un mercado hipotecario maltrecho. Y por propagación -hacia arriba- destruyó el mercado de seguros, reaseguros y garantías y en el downstream, desató una crisis de confianza.

La crítica situación de los mercados modificó el curso y sentido de la inversión productiva internacional.

Hubo un claro reflujo inversionista hacia tierras matrices. Por ahora se refugian en un pensativo wait&see pese a la espectacular recuperación de algunas bolsas.

4º. Ha obligado a la mayor intervención publica que se recuerde con fines de reestructuración bancaria (Planes Brown, Paulson, Geithner,..) y, en general, de los fatigados intermediarios financieros.

La corrección del G20 anuncia el “pinchazo” a las espectaculares burbujas bursátiles, el sinceramiento del dólar, el freno a la incontenible alza de algunas materias primas-refugio.

La agenda incluye, coda, el desbloqueo de las negociaciones comerciales internacionales de la ronda Doha ante la inviabilidad de las políticas de subsidio y de protección vigentes.

Queda pendiente el rol de la crisis en el alisamiento de los desbalances mundiales. Hay que dar solución al gigantesco déficit fiscal (-12.7% PBI) de los EE. UU y el problema del masivo endeudamiento externo que desnivela balanza de cuenta corriente gringa.

5º Las perturbaciones se manifiestan en el mercado mundial de materias primas, petróleo, gas y derivados, bienes salario y alimentos que forman el primer piso de los circuitos productivos internacionalizados y deslocalizados.

Los precios de los metales-commodities como el cobre (“el salario de Chile”, Salvador Allende) han oscilado violentamente, a merced de la especulación financiera. ((Jefferies commodities index). El petróleo fue usado por los operadores como activo de protección al riesgo sistémico. Si hay reactivación gatillará la inflación.

6º La transmisión de la crisis financiera al sector real, el “contagio” quebró segmentos enteros del “fordismo” (Automotriz, General Motors, piezas y partes...). Produjo la ruptura de las líneas de abastecimiento de las transnacionalizadas actividades productivas y el cambio en el patrón de localización de la planta como de transito de los trabajadores emigrantes.

Y se ha agravado la crisis de realización de las mercancías y servicios en los mercados. Al aplanarse el consumo, crecen inventarios y se ralentizan las ventas de maquinaria y equipo.

El corolario del contagio es la destrucción de millones de empleos calificados que difícilmente volverán.

7º La necesidad de un altísimo grado de coordinación de políticas, superior al G8, G20, BRICS o de la institucionalidad de Bretton Woods. A problema global, gobernanza global, sugiere Attali.

¿Para que? Secar las masivas emisiones de papeles, calendarizar la resorción de los medios de pago creados para facilitar liquidez, el desinfle de amenazas mediatas de los mercados bursátiles y la atenuación de la volatilidad entre monedas soberanas. Agregue freno a las peligrosas devaluaciones competitivas o de cierres unilaterales de mercado (buy american, cómprale al Perú.) como barreras al comercio. De otra forma, la inflación acecha.

8º Hay un vertiginoso incremento de la deuda mundial, sobretodo la de los EE.UU., y un peligroso desorden monetario. Nadie duda del impacto de un dólar “flojo” en el mercado de deuda y de los activos financieros. Por lo demás, el supply Chain de Chimerica[7] crea una gigantesca acumulación de reservas cambiarias ($2 billones) en China de la que pende el futuro de la nueva moneda de reserva mundial.

9º. El fracaso de la autorregulación de los mercados. Emergen, afortunadamente, nuevos conceptos, diseños y políticas económicas proactivas fundadas en renovados paradigmas sobre la asimetría de la información, la selección adversa, la teoría de juegos y el análisis de las fallas de funcionamiento de los mercados. Significa que el Estado es útil y que junto a los agentes principales produce medidas regulatorias de los mercados. Por fin.

- Queda pendiente la purga: activos financieros malolientes, pirámides Ponzi-Madoff, fondos de pensiones gitanos, secretosos hedge funds, los BCCI del S.XXI. Deshacer la malla del shadow finance (finanzas en la sombras, desregulada) y hasta extinguir los “paraísos tributarios”, pedidos por el G20-(Londres, abril 2009).

Numerosos trabajos hacen conocer mejor este retrato de la crisis. Facilitan el examen de las salidas posibles en el corto plazo para los países como el Perú.[8]

CONTRA EL PESIMISMO, PREVISION

Para enfrentar esta magna crisis, el Perú requiere una política contracíclica potente.

Quiere decir el uso sincronizado de instrumentos que compensen la caída de la demanda.

Se trata de sostener el nivel de actividad mediante el estimulo de la demanda interna.

¿Para que? Preservar el consumo y defender el empleo, la producción, el ahorro e inversión de las empresas, los ingresos de los exportadores, fortalecer las cuentas públicas, auspiciar el desarrollo de los mercados internos y la construcción de la infraestructura física.

También usar medios eficaces para compensar el déficit en cuenta corriente y la defensa de la posición de cambio del instituto emisor. En fin, contrarrestar los factores desequilibrantes y jerarquizados que provoca la erosión de la demanda agregada.

Para ello se necesitan instrumentos de intervención.

¿Los hay? Si, muy sofisticados.

Las herramientas de política monetaria están disponibles. Fueron construidas y adaptadas por el equipo del Profesor Dancourt[9] y fue asumido por el BCRP desde los primeros días del 2002.[10]

Usa la tasa de interés de referencia como instrumento de la autoridad monetaria, un protocolo de seguimiento cambiario, propio de una economía parcialmente dolarizada, un modelo de previsión para gestionar el programa de inflación objetivo (inflation targeting) que propone escenarios y algunos elementos teóricos de la gestión de portafolios en riesgo.

La política fiscal se funda en el resultado fiscal estructural, la implantación de indicadores lideres, estabilizadores automáticos y autonomía creciente del Estado frente al endeudamiento externo.[11]

La curva de referencia del mercado de bonos del tesoro, formada mediante un programa creador de mercados, es otro instrumento que orienta el financiamiento de la inversión en soles y la formación del mercado secundario de papeles.

Pero lo que importa es que nadie puede alegar carencia de instrumentos.

De su aplicación eficaz depende el resultado del 2009. Contra el pesimismo, previsión y perspectiva.

[1] FMI, Perspectives de l´économie mondiale, aperçu des projections, 8 Juillet 2009.

[2] Tim Geithner declara: « La plupart des prévisionnistes tablent sur une amélioration des indicateurs aux Etats-Unis dès le quatrième trimestre », les Echos, Paris, 18.07.09., Larry Summers: “La economía de Estados Unidos estuvo "al borde de una catástrofe" en enero, pero ha logrado progresos "sustanciales" desde entonces, principal, asesor económico de

[3] N. Roubini, RGE Monitor, July 2009.

[4] Las modestas cifras de ejecución de la inversión pública develan una paradójica aunque no infrecuente contradicción entre la fe y la obra. Una por exceso, la otra por defecto. La crisis no se vence por decreto. Menos aun por una virtud cardinal si la inversión es insuficiente: apenas 22% del presupuesto en el primer semestre, Portal del MEF, 18 de julio 2009

[5] Grundrisse der kritrik der politischen okonomie, ed. francesa, Anthropos, Paris,1967

[6] Los balances semestrales de las empresas cotizadas en bolsas internacionales arrojan perdidas pero su cotización en bolsa sube aunque todavía no recuperan sus niveles de antaño. ¿Burbuja?

[7] China y América, alusión irónica al enlazado sistema que los une en la producción y el consumo, el financiamiento y el tipo de cambio.

[8] Aglietta, Michel, Macroeconomie financière,

[9] Regla de Taylor que acepta los efectos de un régimen bimonetario.

[10] Los resultados fueron: Inflación inferior a 1.5%; 7.5% crecimiento en el 2006; 60 meses ininterrumpidos de expansión; gran acumulación de reservas y un tipo de cambio real de equilibrio levemente positivo.

[11] Al que contribuyeron los profesores Burneo, Jiménez, Mendoza y Schydlowsky, entre otros. La economía despejo un importante saldo de las cuentas fiscales, permitió una mayor autonomía al Estado por la paulatina e inexorable amortización de la deuda externa y el crecimiento de la deuda interna en soles.

-¿Pero la caída del crecimiento es culpa de este gobierno o es consecuencia de la crisis mundial?

-Es una combinación de ambos factores. Se advirtió reiteradas veces de la gravedad de lo que se venía, se le dijo al gobierno que gaste para que haya inversión y consumo, pero el gobierno dio una respuesta frívola e inconsistente, lo que ha tenido como resultado esta caída del crecimiento a casi cero.

-¿Haber acelerado el crecimiento hasta llegar a cerca del diez por ciento el año pasado ha agravado la crisis?

-Así es. El gobierno debió haber modulado el crecimiento a un nivel del siete por ciento, pero en lugar de eso lo lanzó a 150 kilómetros por hora y ahora el carro se está desbarrancando. El gobierno ha tenido una política de corto plazo de acelerar el crecimiento, sabiendo que eso generaría consecuencias negativas a mediano plazo, pero esperaba que la crisis estalle en unos años, cuando ellos ya no estén en el poder, y sea el próximo gobierno el que pague la factura. Pero con la crisis mundial la bomba estalló antes de lo que habían calculado.

-¿Es una ilusión del presidente García pensar que el Perú puede ser un refugio para los inversionistas?

-Eso es una tontería que está al nivel de la locura.

-¿Y decir que el Perú no será muy afectado por la crisis es otra locura?

-Durante mucho tiempo se dijo que estábamos blindados, pero estamos viendo que no es así. La crisis recién está comenzando. En los últimos seis meses del año sentiremos con mayor fuerza su impacto.

-¿Qué medidas debe tomar el gobierno para disminuir la gravedad de ese impacto?

-Hay que proteger el mercado interno, como están haciendo todos los países. Es suicida la actual política de bajar los aranceles y firmar Tratados de Libre Comercio. Es fundamental la inversión en obras de infraestructura de pequeña y mediana dimensión para defender los empleos y los salarios. Se debe mejorar la capacidad de consumo de la población, dándoles mayores ingresos a los trabajadores.

-¿La liberación de las CTS es una buena medida para impulsar el consumo interno?

-Eso es una cortina de humo. Estimulará el consumo solamente por una vez y su impacto será diminuto.

-¿Y cuál será el impacto de la exoneración del pago de aportaciones sociales a las gratificaciones?

-Tendrá un impacto positivo en la economía porque liberará como 400 millones de soles. Pero ese impacto será temporal. Está archiprobado por todas las políticas keynesianas que en una etapa de crisis el único modo de reconstituir el mercado es aumentando los sueldos…

-¿Pero en medio de esta crisis es posible aumentar los sueldos?

-En los últimos años las utilidades han crecido una barbaridad, pero los sueldos han subido muy poco. El Estado no sabe qué hacer con el dinero que no gasta. Y la industria privada para vender necesita que la gente pueda comprar. Bajando el interés referencial, que ahora está en cinco por ciento, a cerca del uno por ciento, como está en casi todos los países, se abarataría el crédito y eso le daría a la industria las condiciones para que expanda su capacidad productiva y así pueda aumentar sueldos.

-¿Cuáles serán los sectores más golpeados por la crisis?

-El sector textil, donde las ventas ya han caído 63 por ciento y la pérdida de empleos es muy importante; la industria del calzado; la agroindustria y las Pymes, particularmente las que trabajan vinculadas a la construcción, donde hay una caída muy fuerte.

-¿Cuánto caerá el crecimiento económico este año?

-El crecimiento del PBI ha bajado de 12,9 por ciento en el pico del 2008, a 0,19 por ciento en febrero de este año. Si esto sigue así, lo más optimista es pensar que el crecimiento estará alrededor de cero…

-El FMI pronostica un crecimiento de 3,5 por ciento para nuestro país este año.

En octubre de 2008, el FMI decía que el 2009 el Perú iba a crecer 6,9 por ciento; ahora ha bajado su cálculo de crecimiento a la mitad. Creo que lo más probable es que dentro de tres meses el FMI vuelva a bajar su pronóstico de crecimiento para el Perú. Si el programa anticrisis funciona, el crecimiento para este año será de cero, pero si no funciona podemos caer a menos cinco por ciento.

-¿Y está funcionando o no el programa anticrisis?

-Hasta ahora ese programa es un fracaso rotundo. Para fines de marzo el Estado debió haber ejecutado el 25 por ciento de los recursos destinados para inversión pública este año, pero la ejecución es de solamente el nueve por ciento. El nivel de gasto en sectores claves está por debajo del cinco por ciento. En el sector Salud y en los programas sociales se ha gastado menos del uno por ciento. Eso es una vergüenza.

-¿Por qué el gobierno tiene tan poca capacidad para gastar lo presupuestado?

-Por ineficacia administrativa y por la corrupción. Sacan a licitación la construcción de hospitales o la compra de ambulancias, por citar dos ejemplos, y se descubre un manejo deshonesto, por lo que las licitaciones se deben anular.

-Su evaluación sobre el manejo económico del gobierno no deja espacio para el optimismo.

-Si no se cambia la política económica y no se mejora la capacidad de gasto del gobierno, los pronósticos son pesimistas, porque la recesión será muy fuerte.

“Gestión de Carranza es catastrófica”

-¿Cómo evalúa la gestión del ministro de Economía, Luis Carranza?

-Es una gestión catastrófica. Su primer fracaso fue el shock de inversiones. En esta segunda gestión ha fracasado con el programa anticrisis de estímulo económico. El ministro Carranza no tiene la capacidad para manejar una política económica. Ha llevado la economía al suelo. Su equipo impide que se movilice el gasto público. En el Congreso se ha descubierto un número impresionante de fondos que el gobierno crea, les asigna recursos y luego nunca se emite el decreto con el reglamento para usar esos fondos, y después con ese mismo dinero se plantean nuevos fondos. Es un truco para evitar gastar.

-¿Cuál es la intención de evitar gastar el dinero que se tiene?

-Existe la plata, están los proyectos, pero no se gasta. Eso es inexplicable, salvo que haya un intento de boicotear al gobierno desde dentro del propio gobierno…

-¿Quiénes podrían querer boicotear al gobierno desde dentro?

-Contraer el Estado en plena crisis es invitar a que la tensión social aumente. No me extrañaría que algunos quieran frenar la acción del Estado para agudizar la crisis y crear un caos en momentos que se puede ver el tema del indulto a Fujimori...

-¿Usted cree que hay un complot fujimorista al interior del gobierno para agravar la crisis?

-No encuentro otra explicación a esta política de frenar el gasto público. No olvidemos que el primer y segundo vicepresidentes de la República son fujimoristas, que en el Banco Central de Reserva está José Chlimper, que ha sido ministro de Fujimori. El ministro Carranza está estrechamente vinculado al Grupo Brescia, que junto con el Grupo Romero fueron parte de la columna vertebral económica del gobierno de Fujimori. Aquí puede haber una operación política compleja para intentar favorecer a Fujimori agravando la crisis, porque eso abre las puertas al autoritarismo, lo que favorecería a Fujimori.

Entrevista: Carlos Noriega en diario La Primera, Lima.

-¿Pero la caída del crecimiento es culpa de este gobierno o es consecuencia de la crisis mundial?

-Es una combinación de ambos factores. Se advirtió reiteradas veces de la gravedad de lo que se venía, se le dijo al gobierno que gaste para que haya inversión y consumo, pero el gobierno dio una respuesta frívola e inconsistente, lo que ha tenido como resultado esta caída del crecimiento a casi cero.

-¿Haber acelerado el crecimiento hasta llegar a cerca del diez por ciento el año pasado ha agravado la crisis?

-Así es. El gobierno debió haber modulado el crecimiento a un nivel del siete por ciento, pero en lugar de eso lo lanzó a 150 kilómetros por hora y ahora el carro se está desbarrancando. El gobierno ha tenido una política de corto plazo de acelerar el crecimiento, sabiendo que eso generaría consecuencias negativas a mediano plazo, pero esperaba que la crisis estalle en unos años, cuando ellos ya no estén en el poder, y sea el próximo gobierno el que pague la factura. Pero con la crisis mundial la bomba estalló antes de lo que habían calculado.

-¿Es una ilusión del presidente García pensar que el Perú puede ser un refugio para los inversionistas?

-Eso es una tontería que está al nivel de la locura.

-¿Y decir que el Perú no será muy afectado por la crisis es otra locura?

-Durante mucho tiempo se dijo que estábamos blindados, pero estamos viendo que no es así. La crisis recién está comenzando. En los últimos seis meses del año sentiremos con mayor fuerza su impacto.

-¿Qué medidas debe tomar el gobierno para disminuir la gravedad de ese impacto?

-Hay que proteger el mercado interno, como están haciendo todos los países. Es suicida la actual política de bajar los aranceles y firmar Tratados de Libre Comercio. Es fundamental la inversión en obras de infraestructura de pequeña y mediana dimensión para defender los empleos y los salarios. Se debe mejorar la capacidad de consumo de la población, dándoles mayores ingresos a los trabajadores.

-¿La liberación de las CTS es una buena medida para impulsar el consumo interno?

-Eso es una cortina de humo. Estimulará el consumo solamente por una vez y su impacto será diminuto.

-¿Y cuál será el impacto de la exoneración del pago de aportaciones sociales a las gratificaciones?

-Tendrá un impacto positivo en la economía porque liberará como 400 millones de soles. Pero ese impacto será temporal. Está archiprobado por todas las políticas keynesianas que en una etapa de crisis el único modo de reconstituir el mercado es aumentando los sueldos…

-¿Pero en medio de esta crisis es posible aumentar los sueldos?

-En los últimos años las utilidades han crecido una barbaridad, pero los sueldos han subido muy poco. El Estado no sabe qué hacer con el dinero que no gasta. Y la industria privada para vender necesita que la gente pueda comprar. Bajando el interés referencial, que ahora está en cinco por ciento, a cerca del uno por ciento, como está en casi todos los países, se abarataría el crédito y eso le daría a la industria las condiciones para que expanda su capacidad productiva y así pueda aumentar sueldos.

-¿Cuáles serán los sectores más golpeados por la crisis?

-El sector textil, donde las ventas ya han caído 63 por ciento y la pérdida de empleos es muy importante; la industria del calzado; la agroindustria y las Pymes, particularmente las que trabajan vinculadas a la construcción, donde hay una caída muy fuerte.

-¿Cuánto caerá el crecimiento económico este año?

-El crecimiento del PBI ha bajado de 12,9 por ciento en el pico del 2008, a 0,19 por ciento en febrero de este año. Si esto sigue así, lo más optimista es pensar que el crecimiento estará alrededor de cero…

-El FMI pronostica un crecimiento de 3,5 por ciento para nuestro país este año.

En octubre de 2008, el FMI decía que el 2009 el Perú iba a crecer 6,9 por ciento; ahora ha bajado su cálculo de crecimiento a la mitad. Creo que lo más probable es que dentro de tres meses el FMI vuelva a bajar su pronóstico de crecimiento para el Perú. Si el programa anticrisis funciona, el crecimiento para este año será de cero, pero si no funciona podemos caer a menos cinco por ciento.

-¿Y está funcionando o no el programa anticrisis?

-Hasta ahora ese programa es un fracaso rotundo. Para fines de marzo el Estado debió haber ejecutado el 25 por ciento de los recursos destinados para inversión pública este año, pero la ejecución es de solamente el nueve por ciento. El nivel de gasto en sectores claves está por debajo del cinco por ciento. En el sector Salud y en los programas sociales se ha gastado menos del uno por ciento. Eso es una vergüenza.

-¿Por qué el gobierno tiene tan poca capacidad para gastar lo presupuestado?

-Por ineficacia administrativa y por la corrupción. Sacan a licitación la construcción de hospitales o la compra de ambulancias, por citar dos ejemplos, y se descubre un manejo deshonesto, por lo que las licitaciones se deben anular.

-Su evaluación sobre el manejo económico del gobierno no deja espacio para el optimismo.

-Si no se cambia la política económica y no se mejora la capacidad de gasto del gobierno, los pronósticos son pesimistas, porque la recesión será muy fuerte.

“Gestión de Carranza es catastrófica”

-¿Cómo evalúa la gestión del ministro de Economía, Luis Carranza?

-Es una gestión catastrófica. Su primer fracaso fue el shock de inversiones. En esta segunda gestión ha fracasado con el programa anticrisis de estímulo económico. El ministro Carranza no tiene la capacidad para manejar una política económica. Ha llevado la economía al suelo. Su equipo impide que se movilice el gasto público. En el Congreso se ha descubierto un número impresionante de fondos que el gobierno crea, les asigna recursos y luego nunca se emite el decreto con el reglamento para usar esos fondos, y después con ese mismo dinero se plantean nuevos fondos. Es un truco para evitar gastar.

-¿Cuál es la intención de evitar gastar el dinero que se tiene?

-Existe la plata, están los proyectos, pero no se gasta. Eso es inexplicable, salvo que haya un intento de boicotear al gobierno desde dentro del propio gobierno…

-¿Quiénes podrían querer boicotear al gobierno desde dentro?

-Contraer el Estado en plena crisis es invitar a que la tensión social aumente. No me extrañaría que algunos quieran frenar la acción del Estado para agudizar la crisis y crear un caos en momentos que se puede ver el tema del indulto a Fujimori...

-¿Usted cree que hay un complot fujimorista al interior del gobierno para agravar la crisis?

-No encuentro otra explicación a esta política de frenar el gasto público. No olvidemos que el primer y segundo vicepresidentes de la República son fujimoristas, que en el Banco Central de Reserva está José Chlimper, que ha sido ministro de Fujimori. El ministro Carranza está estrechamente vinculado al Grupo Brescia, que junto con el Grupo Romero fueron parte de la columna vertebral económica del gobierno de Fujimori. Aquí puede haber una operación política compleja para intentar favorecer a Fujimori agravando la crisis, porque eso abre las puertas al autoritarismo, lo que favorecería a Fujimori.

Entrevista: Carlos Noriega en diario La Primera, Lima.

De acuerdo al reporte del ministerio de economía, que evalúa el impacto de la crisis. Riesgo país está muy cerca de la luz roja, según monitoreo del MEF. Ingresos corrientes y tributarios del gobierno ya están en rojo.

Beatriz Jiménez,PERIODISTA DE la republica Durante la reunión a puerta cerrada que mantuvo la Comisión Intersectorial Anticrisis instalada ayer, el ministerio de Economía repartió a las autoridades asistentes un reporte que mide el impacto de la crisis en 2009.

Durante la reunión a puerta cerrada que mantuvo la Comisión Intersectorial Anticrisis instalada ayer, el ministerio de Economía repartió a las autoridades asistentes un reporte que mide el impacto de la crisis en 2009.

Este reporte, al que pudo acceder La República, trata de resumir la situación económica actual a través de una especie de “semáforo de la crisis”. En vista de las cifras manejadas, el gobierno reconoce en este documento que la economía está en luz ámbar.

“No se trata de asustar a la población, sino de tener la precaución del caso”, declaró el viceministro de Economía Eduardo Morón, autor del reporte. “Se trata de un termómetro que nos permite alertar tempranamente y tomar decisiones de manera oportuna”, explicó.

Cifras en rojo

Las cuentas fiscales son valoradas por el gobierno en luz roja, ya que se encuentran en niveles superiores a la señal de alerta. “ La recaudación se anticipa como negativa debido a la bajada del precio de los minerales (en luz ámbar) y de la actividad económica”, señala Morón.

Según el ex presidente del Banco de Reserva Gonzalo García Núñez, el desbalance en la recaudación de impuestos de Personas Jurídicas se debe, principalmente, a que las mineras han comenzado a no pagar tributos fruto de la bajada del precio del cobre y otros metales.

Alerta amarilla

El riesgo país, un índice internacional que mide el grado de “peligro” que entraña un país para las inversiones extranjeras, se multiplicó por 2 respecto al promedio mantenido de 2004 a 2008.

El otro hecho que constata el documento es que las exportaciones peruanas se han reducido a la mitad en el último trimestre del año, mientras que las importaciones han crecido exponencialmente.

“Dado que hemos tenido un boom en inversiones era natural el crecimiento de las importaciones de maquinaria especial”, justifica el viceministro.

Frente a esta situación de déficit de la balanza comercial se alzan las voces para restaurar los aranceles existentes en 2007.

“Es necesario tomar medidas temporales que eleven los aranceles para una mejor defensa del mercado interno”, señala García Núñez.

Ante esta alerta, el economista Humberto Campodónico considera necesario que el gobierno informe de las respuestas económicas que aplicará para revertir la situación.

“El gobierno ha entendido con claridad que una crisis internacional fuerte nos afectará, que se acabó la época de las vacas gordas y empieza la de las vacas flacas”, opinó, y agregó que hoy es necesario que dé a conocer las respuestas económicas a estas cifras en rojo.

Al igual que García Núñez, Campodónico consideró que una respuesta necesaria es subir los aranceles para disminuir el alza de las importaciones.

Datos

Crecimiento. A pesar de la crisis , la Comisión Económica para América Latina y el Caribe (CEPAL) estimó que en 2009 Perú, con una expansión del 5%, será el país dela región que más crecerá.

Reservas. Perú tiene casi 31 mil millones de dólares en reservas. Esta cifra es la más alta de la región. En el reporte del MEF, la luz roja está en los 15 mil millones. “Perú está sobreasegurado”, dice Morón, aunque reconoce que las reservas disminuirán este año. “Podríamos perder la mitad y aún estaríamos cerca del nivel de países como Chile o Brasil”.