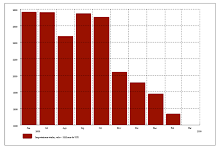

17. TASAS DE INTERES Peru

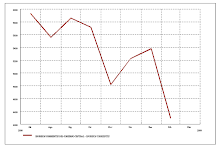

16. tipo de cambio sol/dolar-consulta del dia

V. SECCION: M. PRIMAS

1. SECCION:materias primas en linea:precios

![[Most Recent Quotes from www.kitco.com]](http://www.weblinks247.com/indexes/gfms.gif) |

METALES A 30 DIAS click sobre la imagen

(click sur l´image)

2. PRECIOS MATERIAS PRIMAS

9. prix du petrole

10. PRIX essence

petrole on line

16 mar 2011

NHK: Se detectan altos niveles de radiación a 20 km central

Se detectan altos niveles de radiación a 20 kilómetros de central nuclear dañada en el noreste de Japón

El Ministerio de Ciencia de Japón ha observado niveles de radiación de hasta 0,33 milisieverts por hora en áreas a aproximadamente 20 kilómetros al noroeste de la central nuclear Fukushima Número Uno, dañada por el terremoto.

Los expertos señalan que la exposición a ese nivel de radiación durante tres horas resultaría en una absorción de un milisievert, o el máximo considerado como seguro durante un año.

El ministerio midió los niveles de radiación durante 10 minutos a partir de las 8:40 de la noche, hora local del martes, en tres lugares de la prefectura de Fukushima, en donde se ha recomendado a los residentes no salir a la calle. Las mediciones produjeron lecturas de por lo menos 0,22 milisieverts por hora.

No se sabe si esos niveles han cambiado desde que se hicieron las mediciones.

Shigenobu Nagataki, exdirector de la Fundación de Investigaciones sobre los Efectos de la Radiación, dijo que la radiación a ese nivel no afecta de inmediato la salud humana. Sin embargo, agregó que si se continúan observando esos niveles, las autoridades deben someter a revisión las medidas para evacuar a la gente.

Predicen un otro mega terremoto. Sería en Estados UNidos.

EARTHQUAKE WARNING FROM RUSSIAN INSTITUTE of PHYSICS of the EARTH

Posted by Real News Reporter on March 12th, 2011

A new report released today in the Kremlin prepared for Prime Minister Putin by the Institute of Physics of the Earth, in Moscow, is warning that the America's are in danger of suffering a mega-quake of catastrophic proportions during the next fortnight (14 days) with a specific emphasis being placed on the United States, Mexico, Central America and South American west coast regions along with the New Madrid Fault Zone region.

This report further warns that catastrophic earthquakes in Asia and the sub-continent are, also, "more than likely to occur" with the 7.3 magnitude quake in Japan today being "one of at least 4 of this intensity" to occur during this same time period.

Raising the concerns of a mega-quake occurring, this report says, are the increasing subtle electromagnetic signals that are being detected in the Earth's upper atmosphere over many regions of the World, with the most intense being over the US Western coastal and Midwest regions.

Important to note are that Russian and British scientists are at the forefront of predicting earthquakes based on these subtle electromagnetic signals and have joined in an effort to put satellites in space to detect more of them.

More ominously in this report are Russian scientists confirming the independent analysis of New Zealand mathematician and long-range weather forecaster, Ken Ring, who predicted the deadly Christchurch quake and this week issued another warning of a quake to hit on or about March 20th.

Ring explains his methodology for predicting earthquakes as follows:

"The planets very much affect the earth, indirectly, by having an effect on the Sun. Some planets are very large. If the Sun was a basketball the gas giants Jupiter and Saturn would be the size of grapefruits, and the Earth would be, on that scale, the size of a peppercorn.

Jupiter and Saturn cause extra tides on the Sun when they get on either side of the Sun (as with Moon – Earth-Sun when the moon is full) and when these gas giants get on the same side as the Sun, (as with Earth -Moon – Sun when the moon is new). These greater solar tides become sunspot activity and solar flares and can be understood as akin to the increase in tides caused by the Moon when it too gets alongside Earth or opposite Earth.

At the moment we have Jupiter and Saturn on either side of the Sun and creating a tug of war with Earth in the middle. That started last September and will continue until about May. In September the Earth was right in line with Jupiter, Saturn and the Sun too.

That's why there were several 7+ earthquakes around, it wasn't just us. For instance there was one in Pakistan on the same day as Christchurch. This Jupiter/Saturn alignment continues until about May, and the Earth comes back into line as well in March. It is why there may be an extreme event, perhaps a large earthquake, around 20 March, which is when the Moon may be again in a trigger position."

According to this report, however, where Ring is correct in assessing blame for our Earth's earthquakes on the Sun and Planets, his substituting of Perigean Spring Tides (also known as King Tides) for the low pressure systems associated with them may be incorrect.

The mention in this report of massive low pressure systems being associated with catastrophic earthquakes is especially dire to the United States Midwestern region, which even today is continuing to be pounded by horrific rainfall amounts, and most especially impacting the New Madrid Fault Zone State of Arkansas which has suffered over 800 earthquakes in the past 6 months alone.

Equally in danger, this report continues, is the South American Nation of Bolivia which has, likewise, suffered catastrophic low pressure system storms that in the past week have killed over 52 people.

Most ominous in this report, though, is its warning that the fault-riddled State of California may be about to suffer its most catastrophic earthquake in decades as new reports for this region show the mass death of millions of fish [photo bottom left] is now occurring, and just like the mass stranding of whales on New Zealand beaches days prior to the February 22nd destruction of Christchurch.

Making the situation for our Planet even grimmer are the reports that our Sun is continuing to spew forth massive solar flares, the latest warned to hit our Earth today or tomorrow thus prompting the Hermanus Space Weather Warning Centre (SWWC) to issue a Solar Flare warning for the Southern Hemisphere.

Interesting to note in all of these events is the United States Army announcing this week that it is holding a rare training event involving the US Military, the CIA, Canadian officers, US Treasury and State departments, the US Agency for International Development, the Defense Threat Readiness Agency and the International Red Cross between March 21-25 at Fort Leavenworth, Kansas, and which should the worst happen they will certainly be prepared for it.

As this report concludes, that as of yet, "no firmly reliable" method for predicting earthquakes has been scientifically recognized, it is well worth noting the too many to be ignored anomalous coincidences leading up to catastrophic mega-quakes are breaking out all over the World and should only be ignored at ones peril.

In other words, it is always best to be prepared should disaster strike, wherever the warning comes from.

12 mar 2011

French greens call for end to nuclear energy

French greens call for end to nuclear energy

By James Regan and Laure Bretton

PARIS | Sat Mar 12, 2011 11:35am EST

(Reuters) - French green groups renewed a call on Saturday for France to end its dependence on nuclear power, saying a radiation leak at a Japanese atomic power plant showed there were no safety guarantees in the industry.

The Japanese Daiichi 1 facility north of Tokyo started leaking radiation after an explosion blew the roof off the plant that had been shaken in a massive earthquake on Friday, raising fears of a meltdown.

French officials were due to meet to discuss the situation and possible precautionary measures, but green groups said it was time to dump a technology that had led to the worst civilian nuclear disaster in Chernobyl in 1986.

"It's clear that when there's a significant natural disaster, all the so-called safety measures fail in a country with the highest level of technical know-how," Cecile Duflot, head of the green Europe Ecologie-Les Verts party, told Reuters.

"The nuclear risk is not a risk that can really be controlled."

France has 58 nuclear reactors spread over 19 sites, providing almost four-fifths of the country's electricity and making it the second-biggest nuclear country after the United States. Japan has 55 nuclear reactors.

French anti-nuclear network "Sortir du nucleaire" described Japan's stricken nuclear plant as a "new Chernobyl."

"This is indeed a very serious nuclear accident that is currently taking place in Japan, of a severity comparable to that of Three Mile Island and that of Chernobyl, which took place just about 25 years ago," the group said in a statement.

Chernobyl exploded in 1986, spewing out clouds of radioactivity. Human and technical error caused a confused response at Three Mile Island in Pennsylvania, leading to a meltdown of the core and a write-off of the reactor in 1979.

Japan's nuclear safety agency said they rated the incident as less serious than both accidents. [nTKZ00680]

Nuclear experts also said the explosion at the Japanese reactor should not reach the magnitude of Chernobyl because the reactor's core seemed to be intact.

But Greenpeace said the situation was "more and more alarming."

"An explosion in one reactor could already have released very high doses of radioactivity, and other reactors also seem to be in a critical situation," Greenpeace said in a statement.

France's ASN nuclear safety authority said it was stepping up the monitoring of air quality over France.

The president of the IRSN radiation protection and nuclear safety institution, Agnes Buzyn, told a news conference that real-time data on air quality would be made available to reassure the public.

Buzyn and ASN President Andre-Claude Lacoste were due to meet Ecology Minister Nathalie Kosciusko-Morizet, Energy Minister Eric Besson and top executives from nuclear reactor maker Areva and power giant EDF at the ecology ministry later on Saturday.

(Additional reporting by Matthias Blamont; editing by Elizabeth Piper)

4 mar 2011

Subida de tipos a la vista, ¿se dirige Europa a la estanflación?

El Banco Central Europeo (BCE) ha decidido en su reunión del jueves 3, como era previsible, mantener los tipos de interés de referencia en la zona euro en el 1%, al mismo nivel que en los últimos 22 meses; y ello a pesar de que el reciente incremento del precio del petróleo ha disparado la inflación de la eurozona en febrero al 2,4% (3,6% en España). Sin embargo, el presidente del BCE, Jean-Claude Trichet, ha comentado en la rueda de prensa posterior que el banco central mantendrá una fuerte vigilancia, con el objetivo de contener los riesgos al alza en los precios.

Esta expresión ha sido utilizada habitualmente por el BCE para señalizar a los mercados una inminente subida de los tipos de interés. Parece, por lo tanto, que nos encontramos ante una nueva vuelta de tuerca en las consecuencias del conflicto de Libia y Oriente Medio, que forzará al BCE a elevar los tipos en el futuro próximo, aportando un argumento más para temer una recaída de las economías europeas.

El epicentro de estas alteraciones económicas se encuentra en la escalada que ha experimentado el precio del crudo en las últimas semanas, que lo ha llevado a acercarse a los 120 dólares el barril, es decir, 40 dólares más que hace tan sólo 10 meses y en máximos desde el verano de 2008.

La causa de este incremento tan significativo no se encuentra sólo en la interrupción de la producción de crudo de Libia -que representa tan sólo cerca del 2% de la producción mundial-, sino en el riesgo de que el conflicto pueda extenderse a otros países productores de petróleo de la zona. En dicha coyuntura, la disminución de la oferta sería de tal magnitud que no podría ser compensada por el aumento en la producción de, la relativamente colaboradora, Arabia Saudita, generando, en consecuencia, escasez de oferta en el mercado.

Por otro lado, los efectos del encarecimiento del crudo se han dejado ya notar en las economías europeas. No hay que olvidar que el incremento de precio del petróleo funciona como un impuesto para los países consumidores que es recaudado por los países productores. Por lo tanto, provoca una disminución de la renta de los países europeos, Estados Unidos, Japón o los emergentes asiáticos y un incremento de la de los países de Oriente Medio, algunos africanos, Rusia y demás productores.

Así, en Europa, las empresas han sufrido un incremento en sus costes energéticos y los consumidores deben pagar más por llenar los depósitos de sus vehículos; experimentando, por consiguiente, una caída en su renta disponible. En otras circunstancias los gobiernos podrían haber tratado de compensar la disminución de la renta de los ciudadanos bajando los impuestos, pero con las frágiles finanzas públicas actuales -consecuencia de la reciente crisis financiera internacional- el margen de actuación en esa área es extremadamente limitado.

Sin embargo, aquí no acaban las consecuencias que el aumento del precio del petróleo puede provocar sobre las economías europeas, ya que ese incremento generará, además, muy probablemente, un alza en los tipos de interés.

En otras circunstancias, los gobiernos podrían haber tratado de compensar la disminución de la renta de los ciudadanos bajando los impuestos, pero con las frágiles finanzas públicas actuales el margen de actuación es extremadamente limitado

Y es que el BCE, al contrario de lo que sucede con la Reserva Federal (FED) en Estados Unidos –que tiene una doble meta de estabilidad de precios y crecimiento económico–, tiene el único objetivo de mantener la inflación a medio plazo por debajo del 2%. Así, dado que actualmente la inflación se encuentra en el 2,4%, es decir, cuatro décimas por encima del objetivo –y teniendo en cuenta que las expectativas de inflación del BCE no son muy halagüeñas–, su futura intervención para aumentar los tipos de interés está prácticamente garantizada.

Esto se debe al temor que provocan en el BCE los denominados efectos de segunda vuelta. Si las demandas de incrementos salariales en Europa utilizan como referencia la inflación actual, los consecuentes aumentos salariales serán tales que provocarán de nuevo alzas en la inflación, dando lugar a una espiral precios-salarios, que, de producirse, obligará al BCE a aumentar los tipos de interés en la zona Euro, no ya en el tercer trimestre de 2011, como se descontaba hasta hace unos días, sino bastante antes.

Una crisis nefasta

Lamentablemente, el momento en que ha irrumpido la crisis de Libia y la potencial subida de tipos -con las economías europeas recién salidas del pozo de la recesión, y la española, aún en el fondo, pero suspirando con que el crecimiento de sus socios europeos le facilite la escalera necesaria para subir las paredes que por sí sola no podía ascender- resulta nefasto desde el punto de vista económico.

En ese panorama gris -de economías débiles y empobrecidas por los efectos directos del incremento del precio del petróleo expuestos anteriormente-, el aumento de tipos de interés supondrá un encarecimiento del crédito para los consumidores y las empresas, erosionando por lo tanto el consumo y la inversión -lo que es tanto como decir la demanda interna, el crecimiento, y el, ya de por sí noqueado, empleo-.

De hecho, aunque el BCE no haya aumentado el jueves los tipos, el Euribor, que sirve de referencia para fijar la mayoría de las hipotecas en España, ya ha experimentado ascensos continuos en los últimos días, reflejando la previsión de los mercados de que el BCE subirá próximamente los tipos de interés.

Pero, desgraciadamente, las amenazas no se limitan a la demanda interna, sino que también la externa puede verse afectada; y ello por dos motivos. En primer lugar, porque la caída de renta de nuestros principales socios comerciales, es decir los países consumidores de petróleo, puede provocar una menor demanda de nuestras exportaciones. En segundo lugar, porque el previsible aumento de tipos en la zona Euro, al hacer más atractivas las inversiones en esta moneda, presionará el Euro al alza, encareciendo nuestras exportaciones y abaratando nuestras importaciones.

Y esto es algo que ya está ocurriendo, pues el Euro se ha fortalecido en las últimas sesiones alcanzando el jueves, tras las palabras de Jean-Claude Trichet, un nuevo máximo de cuatro meses en su cotización respecto al dólar, rozando los 1,4 dólares por Euro.

En definitiva, al impacto negativo directo del incremento en el precio del petróleo sobre la renta de los países europeos, se pueden unir próximamente las consecuencias negativas derivadas de una subida de los tipos de interés por el BCE, que amenazan la tibia recuperación en Europa y despiertan, de nuevo, el fantasma de la recesión o, peor aún, de estancamiento combinado con inflación, es decir, estanflación.

Así, los acontecimientos en el norte de África y Oriente Medio, que tantas expectativas suscitan desde el punto de vista político, pueden acabar quebrando la V (recesión-expansión) que dibujaba la evolución de las economías europeas, convirtiéndola en una W (recesión-expansión-recesión-expansión), y, como corolario, empañando las perspectivas en España de que la L (recesión-estancamiento) en la que estamos sumidos se pueda convertir en una U (recesión-estancamiento-expansión).

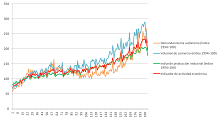

Alemania la China de Europa

How Germany Became the China of Europe

There is no particularly special technology needed to make a chainsaw. It's really just plastic and metal parts screwed together with old-fashioned nuts and bolts. The Chinese already make chainsaws. But that hasn't stopped German power-tool manufacturer Stihl from selling its made-in-Germany chainsaws around the world, even though its top-end models are among the priciest on the market. In fact, 86% of the products Stihl makes in its high-cost German factories are exported. How Stihl manages that says a lot about the impact a revived German economy is having on Europe and the world — both good and bad.

The family-owned firm, based near Stuttgart in Germany's south, could shift more production to its lower-wage factories in China and Brazil, but management is committed to manufacturing many of its most advanced products at home. In contrast to the American habit of outsourcing as much as possible, about half the parts in a German-made chainsaw — from the chain to the crankshaft — are produced in Stihl factories, and many of them are made in Germany. And instead of laying off staff during the Great Recession, as so many U.S. firms did, Stihl locked in highly trained talent by offering full-time workers an employment guarantee until 2015. Stihl even added specialists to its product-development team during the downturn. The result is high-quality products that command price tags big enough — professional Stihl chainsaws cost as much as $2,300 in Germany — to make manufacturing profitable even with the nation's high wages. U.S. companies "don't try hard enough to keep production inside the country," says Stihl chairman Bertram Kandziora. (Watch TIME's video "Global Business Tips: Germany.")

Stihl defines how Germany resurrected its economy — and how the U.S. might too. The small, often family-owned enterprises that make up the backbone of German manufacturing have historically specialized in the unsexy side of the industrial spectrum: not smart phones or iPads but machinery and other heavy equipment, metal bashing infused with sound technology and disciplined engineering. But in recent years, German firms, aided by farsighted government reforms, have turned that into an art form, forging the most competitive industrial sector of any advanced economy. The proof is a boom in exports, which jumped 18.5% in 2010, that is the envy of the developed world.

That surge has carried Germany out of the Great Recession more quickly than most major industrialized countries. GDP rose 3.6% in 2010, compared with 2.9% in the U.S. While joblessness in the U.S. and much of Europe has spiked to levels not seen in decades, unemployment in Germany has declined during the crisis, to an estimated 6.9% in 2010 from 8.6% in 2007, according to the Organisation for Economic Co-operation and Development (OECD). "Germany is in a very competitive position today, more than ever," proclaims Stéphane Garelli, director of the World Competitiveness Center at the Swiss business school IMD. (See pictures of the dangers of printing money in Germany.)

Germany's revival has reversed its role in Europe. Less than a decade ago, Germany was a bumbling behemoth beset by chronic unemployment and pathetic growth. As its more aggressive neighbors such as Spain, Britain and Ireland rode the craze in global finance to stellar performances, they looked at Germany as their stodgy old uncle, unable to change outdated, socialist habits and adapt to a new world. But the financial crisis proved just the opposite. While Spain, Ireland and other former euro-zone highflyers tumble into debt crises, victims of excessive exuberance and risky policies, a steady but reformed Germany has emerged as Europe's dominant economic power. According to the OECD, Germany accounted for 60% of the GDP growth of the euro zone in 2010, up from only 10% in the early 2000s. "We changed from the sick man of Europe to the engine," says Steffen Kampeter, parliamentary state secretary at Germany's Ministry of Finance in Berlin.

Germany's engine, however, has spewed toxic fumes. As manufacturers rev exports, the rest of Europe has been unable to compete. Some 80% of Germany's trade surplus is with the rest of the European Union. The more German industry excels, the more other Europeans feel that Germany's success comes at their expense, cracking open schisms within the euro zone just when the region can least afford them. "There is frustration with Germany," says André Sapir, a senior fellow at Bruegel, a Brussels-based think tank. "Germany is moving ahead, but what are they doing for the rest of Europe?"

ENTREVISTAS TV CRISIS GLOBAL

Etiquetas

- 1 MAYO

- 2

- 2002

- 2007

- 2008

- 2009

- 2010

- 2011

- 2012

- 2013

- 2014

- 2015

- 2016

- 2o11

- 2OO9

- a

- abr2015

- abril09

- abril10

- acc

- actualidadecono

- AFP

- AFPS

- AFRICA

- Ago11

- AGOS

- AGOST10

- agost12

- AGOSTO2008

- AGOSTO2009

- agosto2015

- AGRO

- AGROEXPORTACION

- AIG

- AL

- ALAGROEXPORTACION

- ALEMANIA

- ALIMENTOS

- amazonia

- AMERICALATINA

- ANDAHUAYLAS

- APEC

- ARCH MES

- ARGENTINA

- asarco

- ASIA

- ATTAC

- australia

- AUTOMOVIL

- AVAAZ

- b

- BAILOUT

- baltic

- BANCOS

- BC

- BCE

- BCRP

- benassy

- benedetti

- BERNANKE

- bernis

- BIELORUSIA

- BIS

- blanchard

- BOE

- BOJ

- BOLIVIA

- BOLSA

- BONUS

- BRASIL

- BRIC

- BUBBLE

- bundesbank

- C

- c rec

- CAFE

- CAMBIOCLIMATICO

- CAMERICAS

- CAN

- CANADA

- CANCION

- CAPITALISMO

- castro

- CDO

- cepij

- CHAVEZ

- cheque

- CHILE

- chimerica

- CHINA

- CHRYSLER

- CICLO

- CIE

- ciencia

- CIP

- COBRE

- COLOMBIA

- COMERCIO

- commodities

- COMPUTO

- CONSTRUCCION

- CONSUMO

- CONTAGIO

- control

- COPENHAGUE

- CORRUPCION

- coursera

- CRECIMIENTO

- CREDITO

- CRISIS

- CUBA

- CUMBREALCUE

- CUMBREALCUSA

- davos

- DEC08

- DEC11

- dec12

- DEC13

- dec15

- DEFICIT

- DEFLACION

- demanda

- DEPRESION

- DERIVADOS

- DEUDA

- developpement

- DIC09

- DIC10

- dic12

- DICIEMBRE

- do

- DOLAR

- doubledip

- dsk

- dubai

- duracion

- ec

- ecologo

- ECONOMIA

- ECUADOR

- EDUCA

- efectos

- EMPLEO

- EN11

- en16

- EN2016

- encuesta

- ene016

- energia

- ENERO

- ENERO09

- enero10

- EST

- eu

- EURO

- expansion

- EXPORTACION

- f

- fannie

- feb09

- feb10

- feb13

- feb15

- FED

- filo

- fin

- FINANZAS

- FINLANDIA

- fisica

- flu

- FMI

- FONDOS

- fr

- FRANCE

- frankfurt

- frontrunning

- fukushima

- G20

- G7

- GAS

- geab

- GEITHNER

- gini

- GLO

- global

- GM

- GONZALO GARCIA

- grece

- GREENSPAN

- GRENOBLE

- gripeporcina

- grupo mexico

- HAITI

- hambre

- HEDGE FUNDS

- HIPOTECA

- hist

- HOLLANDE

- HONDURAS

- IMPORTACION

- IMPUESTOS

- INDE

- INDIGNADOS

- INDUSTRIAL

- INFLACION

- INFORMALIDAD

- INFRAESTRUCTURA

- INGENIERIA

- INGENIEROS

- innova

- INTEGRACION

- INTERNACIONAL

- INVERSION

- IRAN

- IRLANDA

- ISLANDIA

- ismea

- ITALIA

- IZQ

- JAPON

- JUL11

- JULIO08

- JULIO09

- JULIO15

- JUN09

- jun10

- jun11

- JUN12

- jun13

- jun15

- JUNIO08

- keynes

- KRUGMAN

- lagarde

- LAREPUBLICA

- leap

- leverage

- liquidez

- LITIO

- lme

- LR

- macro

- MACROECONOMICS

- madera

- MADOFF

- MAMBIENTE

- MANGO

- MARS09

- mars10

- marx

- matematicas

- MATERIASPRIMAS

- MATUK

- MAY09

- MAY11

- MAY12

- MAY13

- may15

- may2015

- MAYO

- MBS

- me

- mef

- MERKEL

- METALES

- MEXICO

- miga

- MIGRA

- MINERIA

- MODELES

- MONDE

- MONEDA

- mourey

- MUJICA

- MUNDO

- musica clasica

- NACIONALIZACION

- neural

- niño

- nobel

- NOTASEMANAL

- NOV08

- nov09

- nov10

- NOV11

- NOV12

- nov15

- nuclear

- OBAMA

- OCDE

- oct09

- oct10

- OCT11

- oct12

- OCTUBRE08

- OFCE

- OIT

- OMC

- ORO

- paita

- PANAMA

- PAPA

- PARADIS

- PARAGUAY

- PAULSON

- pbi

- pe

- PEÑAFLOR

- PERU

- pesca

- PETROLEO

- piketty

- PLAN

- PMI

- POBLA

- POBREZA

- POL

- POLITICA

- porter

- portugal

- postcrisis

- PPT_CRISIS

- PRODUCCION

- PRODUCTIVIDAD

- profits

- prog

- PROTECCION

- QUIEBRA

- r

- RECESION

- REGULACION

- REMESAS

- REPEC

- REPRISE

- REPSOL

- RESERVAS

- RETAIL

- RGE

- RIESGOPAIS

- RMBS

- ROBOTICA

- RODRIK

- ROUBINI

- RUSIA

- SALARIOS

- SARKO

- school paris

- sep11

- SEP15

- SEQUIA

- SERVICIOS

- set09

- set10

- set11

- set12

- SET15

- SETIEMBRE08

- SINGAPUR

- SIRIA

- sismo

- soros

- southern

- SPAIN

- STANFORD

- STIGLITZ

- SUBPRIMES

- SUISSE

- SYRIZA

- TAIWAN

- TARIFAS

- TAS

- TCAMBIO

- TECNOLOGIA

- TERRITORIO

- TEXTIL

- TINTERES

- TLC

- TPP

- trabajo

- trentin

- TRICHET

- TROIKA

- tsunami

- TURISMO

- TV

- UBS

- UE

- UK

- UKRANIA

- UNASUR

- URUGUAY

- USA

- v

- VENEZUELA

- VIDEO

- vivienda

- WALL STREET

- WS

- wsj

- YEN

- young

- YUAN

- Zbasura

- zerohedge

Peru:crisis impacto regional arequipa,raul mauro

Temas CRISIS FINANCIERA GLOBAL

claves para pensar la crisis

-Tipo de cambio

- DIARIOS DE HOY

PRESS CLIPPINGS-RECORTES PRENSA-PRESSE..

canciones de GRACIAS A LA VIDA !

ETIQUETAS alfabetico

- 1 MAYO

- 2

- 2002

- 2007

- 2008

- 2009

- 2010

- 2011

- 2012

- 2013

- 2014

- 2015

- 2016

- 2o11

- 2OO9

- a

- abr2015

- abril09

- abril10

- acc

- actualidadecono

- AFP

- AFPS

- AFRICA

- Ago11

- AGOS

- AGOST10

- agost12

- AGOSTO2008

- AGOSTO2009

- agosto2015

- AGRO

- AGROEXPORTACION

- AIG

- AL

- ALAGROEXPORTACION

- ALEMANIA

- ALIMENTOS

- amazonia

- AMERICALATINA

- ANDAHUAYLAS

- APEC

- ARCH MES

- ARGENTINA

- asarco

- ASIA

- ATTAC

- australia

- AUTOMOVIL

- AVAAZ

- b

- BAILOUT

- baltic

- BANCOS

- BC

- BCE

- BCRP

- benassy

- benedetti

- BERNANKE

- bernis

- BIELORUSIA

- BIS

- blanchard

- BOE

- BOJ

- BOLIVIA

- BOLSA

- BONUS

- BRASIL

- BRIC

- BUBBLE

- bundesbank

- C

- c rec

- CAFE

- CAMBIOCLIMATICO

- CAMERICAS

- CAN

- CANADA

- CANCION

- CAPITALISMO

- castro

- CDO

- cepij

- CHAVEZ

- cheque

- CHILE

- chimerica

- CHINA

- CHRYSLER

- CICLO

- CIE

- ciencia

- CIP

- COBRE

- COLOMBIA

- COMERCIO

- commodities

- COMPUTO

- CONSTRUCCION

- CONSUMO

- CONTAGIO

- control

- COPENHAGUE

- CORRUPCION

- coursera

- CRECIMIENTO

- CREDITO

- CRISIS

- CUBA

- CUMBREALCUE

- CUMBREALCUSA

- davos

- DEC08

- DEC11

- dec12

- DEC13

- dec15

- DEFICIT

- DEFLACION

- demanda

- DEPRESION

- DERIVADOS

- DEUDA

- developpement

- DIC09

- DIC10

- dic12

- DICIEMBRE

- do

- DOLAR

- doubledip

- dsk

- dubai

- duracion

- ec

- ecologo

- ECONOMIA

- ECUADOR

- EDUCA

- efectos

- EMPLEO

- EN11

- en16

- EN2016

- encuesta

- ene016

- energia

- ENERO

- ENERO09

- enero10

- EST

- eu

- EURO

- expansion

- EXPORTACION

- f

- fannie

- feb09

- feb10

- feb13

- feb15

- FED

- filo

- fin

- FINANZAS

- FINLANDIA

- fisica

- flu

- FMI

- FONDOS

- fr

- FRANCE

- frankfurt

- frontrunning

- fukushima

- G20

- G7

- GAS

- geab

- GEITHNER

- gini

- GLO

- global

- GM

- GONZALO GARCIA

- grece

- GREENSPAN

- GRENOBLE

- gripeporcina

- grupo mexico

- HAITI

- hambre

- HEDGE FUNDS

- HIPOTECA

- hist

- HOLLANDE

- HONDURAS

- IMPORTACION

- IMPUESTOS

- INDE

- INDIGNADOS

- INDUSTRIAL

- INFLACION

- INFORMALIDAD

- INFRAESTRUCTURA

- INGENIERIA

- INGENIEROS

- innova

- INTEGRACION

- INTERNACIONAL

- INVERSION

- IRAN

- IRLANDA

- ISLANDIA

- ismea

- ITALIA

- IZQ

- JAPON

- JUL11

- JULIO08

- JULIO09

- JULIO15

- JUN09

- jun10

- jun11

- JUN12

- jun13

- jun15

- JUNIO08

- keynes

- KRUGMAN

- lagarde

- LAREPUBLICA

- leap

- leverage

- liquidez

- LITIO

- lme

- LR

- macro

- MACROECONOMICS

- madera

- MADOFF

- MAMBIENTE

- MANGO

- MARS09

- mars10

- marx

- matematicas

- MATERIASPRIMAS

- MATUK

- MAY09

- MAY11

- MAY12

- MAY13

- may15

- may2015

- MAYO

- MBS

- me

- mef

- MERKEL

- METALES

- MEXICO

- miga

- MIGRA

- MINERIA

- MODELES

- MONDE

- MONEDA

- mourey

- MUJICA

- MUNDO

- musica clasica

- NACIONALIZACION

- neural

- niño

- nobel

- NOTASEMANAL

- NOV08

- nov09

- nov10

- NOV11

- NOV12

- nov15

- nuclear

- OBAMA

- OCDE

- oct09

- oct10

- OCT11

- oct12

- OCTUBRE08

- OFCE

- OIT

- OMC

- ORO

- paita

- PANAMA

- PAPA

- PARADIS

- PARAGUAY

- PAULSON

- pbi

- pe

- PEÑAFLOR

- PERU

- pesca

- PETROLEO

- piketty

- PLAN

- PMI

- POBLA

- POBREZA

- POL

- POLITICA

- porter

- portugal

- postcrisis

- PPT_CRISIS

- PRODUCCION

- PRODUCTIVIDAD

- profits

- prog

- PROTECCION

- QUIEBRA

- r

- RECESION

- REGULACION

- REMESAS

- REPEC

- REPRISE

- REPSOL

- RESERVAS

- RETAIL

- RGE

- RIESGOPAIS

- RMBS

- ROBOTICA

- RODRIK

- ROUBINI

- RUSIA

- SALARIOS

- SARKO

- school paris

- sep11

- SEP15

- SEQUIA

- SERVICIOS

- set09

- set10

- set11

- set12

- SET15

- SETIEMBRE08

- SINGAPUR

- SIRIA

- sismo

- soros

- southern

- SPAIN

- STANFORD

- STIGLITZ

- SUBPRIMES

- SUISSE

- SYRIZA

- TAIWAN

- TARIFAS

- TAS

- TCAMBIO

- TECNOLOGIA

- TERRITORIO

- TEXTIL

- TINTERES

- TLC

- TPP

- trabajo

- trentin

- TRICHET

- TROIKA

- tsunami

- TURISMO

- TV

- UBS

- UE

- UK

- UKRANIA

- UNASUR

- URUGUAY

- USA

- v

- VENEZUELA

- VIDEO

- vivienda

- WALL STREET

- WS

- wsj

- YEN

- young

- YUAN

- Zbasura

- zerohedge

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/spot-copper-30d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/zinc-d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/lead-d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/spot-nickel-30d.gif)