Laura Carlsen

Since the North American Free Trade Agreement (NAFTA) became the law of the land, millions of Mexicans have joined the ranks of the hungry. Malnutrition is highest among the country's farm families, who used to produce enough food to feed the nation.

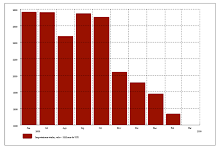

As the blood-spattered violence of the drug war takes over the headlines, many Mexican men, women, and children confront the slow and silent violence of starvation. The latest reports show that the number of people living in "food poverty" (the inability to purchase the basic food basket) rose from 18 million in 2008 to

20 million by late 2010.

About one-fifth of Mexican children currently suffer from malnutrition. An innovative

measurement applied by the National Institute for Nutrition registers a daily count of 728,909 malnourished children under five for October 18, 2011. Government statistics report that

25 percent of the population does not have access to basic food.

Since the 2008 food crisis, there has been a three percent rise in the population without adequate access to food. The number of children with malnutrition is 400,000 kids above the goal for this year. Newborns show the highest indices of malnutrition, indicating that the tragedy begins with maternal health.

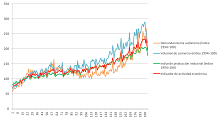

The dramatic change in Mexican eating habits since NAFTA is not only reflected in the millions who go to bed hungry. On the other side of the scale, Mexico has in just a decade and a half become second only to the United States worldwide in morbid obesity. Child obesity, overweight, and diabetes now constitute major health problems, alongside the more traditional problem of hunger.

It's not that the rich are getting too fat and the poor too thin, although inequality plays a role in the erosion of healthy diets for all. Fatness no longer represents abundance. It is the poor who drink cheap Coca Cola when they do not have access to potable water or who give their kids a bag of potato chips when local fresh food is no longer available.

The International Journal of Obesity finds that worldwide the spread of what they call "the Western diet" ("high in saturated fats, sugar, and refined foods but low in fiber) has meant that "the burden of obesity is shifting towards the poor." The NAFTA generation reflects the paradigm so eloquently described by food researcher and activist Raj Patel of "stuffed and starved".

With another food crisis looming due to rising international prices, Mexico could face food riots as well as the spread of starvation and its consequences over the coming year.

Unless the riots turn violent or spark more widespread social upheaval as they did in Arab countries, it's not likely that the news media will pay any attention.

NAFTA's Food (In)security Model

Something has gone terribly wrong. The nation that was slated for prosperity when it signed NAFTA has become an international example of severe structural problems in the food chain, from how it produces its food to what and how much (or how little) it consumes.

Mexican malnutrition has its roots in the way NAFTA and other neoliberal programs forced the nation to move away from producing its own basic foods to a "food security" model. "Food security" posits that a country is secure as long as it has sufficient income to import its food. It separates farm employment from food security and ignores unequal access to food within a country.

The idea of food security based on market access comes directly from the main argument behind NAFTA of "comparative advantage." Simply stated, economic efficiency dictates that each country should devote its productive capacity to what it does best and trade liberalization will guarantee access across borders.

Under the theory of comparative advantage, most of

Mexico was deemed unfit to produce its staple food crop, corn, since its yields were way below the average for its northern neighbor and trade partner. Therefore, Mexico should turn to corn imports and devote its land to crops where it supposedly had a comparative advantage, such as counter-seasonal and tropical fruits and vegetables.

Sounds simple. Just pick up three million inefficient corn producers (and their families) and move them into manufacturing or assembly where their cheap labor constitutes a comparative advantage. The cultural and human consequences of declaring entire peasant and indigenous communities obsolete were not a concern in this equation.

Seventeen years after NAFTA, some

two million farmers have been forced off their land by low prices and the dismantling of government supports. They did not find jobs in industry. Instead most of them became part of a mass exodus as the number of Mexican migrants to the United States rose to half a million a year. In the first few years of NAFTA, corn imports tripled and the producer price fell by half.

Conversion to other crops turned out to take years in most cases. Prices were volatile and harvests unreliable. It was not feasible at all on many small, often rocky plots where corn guarantees a subsistence diet for farm families. Niche markets failed to grow to much more than 2 percent of total agricultural production.

The areas that adapted successfully to industrial agriculture and agroexport crops are characterized by flagrant violation of the labor rights of migrant farm workers, widespread pollution and water waste, and extreme concentration of land and resources.

For the hungry, this means that prices set on the international market determine who eats and who starves. Mexican consumers now pay more for tortillas and food in general. Price hikes on the international market push basic food out of reach for the millions of poor in the country.

Food Dependency

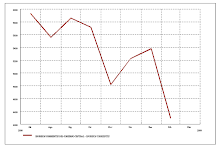

In post-NAFTA Mexico, 42 percent of the food consumed comes in from abroad. Before NAFTA, the country spent $1.8 billion dollars on food imports. It now spends a whopping $24 billion.

Mexico imports 33 percent of its consumption, a figure that belies the reliance on imports because the sheer volume of consumption is so large. Ladrón de Guevara states that it has gone from importing around 250,000 tons before NAFTA to 13 million tons. Transnational traders often favor imports over national production because of the attractive credit arrangements offered by the United States, making it "a double business—importing corn and money."

The U.S. department of agriculture estimates that if current trends continue Mexico will acquire 80 percent of its food from other countries (mostly the United States). The UN's Food and Agriculture Organization calls a country food dependent when the

cost of its imports exceeds 25 percent of total exports. Peasant farmer

organizations have criticized the definition as ludicrous in an oil-producing country that nonetheless has seen serious erosion in its capacity to feed its people and guarantee access to basic foods for all.

Heads I Win, Tails You Lose

The corporate takeover of Mexico's food system has led to the food and health catastrophe. Transnational food corporations not only import freely into Mexican food markets, they are now the producers, exporters, and importers all in one, operating inside the country.

Since NAFTA, corporations have gobbled up human and natural resources on an almost unbelievable scale. Livestock production has moved from small farms for local markets to Tyson, Smithfield, and Pilgrims Pride. The massive use and contamination of water and land has led to health and environmental disasters across the country. Millions of jobs have been lost to concentration and industrialized farming methods.

Take the case of

Corn Products International (CPI). The transnational filed

a NAFTA claim against the Mexican government in 2003, claiming a loss to its business due to a tax levied on high fructose corn syrup in beverages. Mexico's reason for imposing the tax was to save a sugarcane industry that provided jobs for thousands of citizens and played a crucial economic role in many regions. The government was also frustrated by its failure under NAFTA to access the highly protected U.S. sugar market.

A 2008 NAFTA tribunal ruled that Mexico had to pay $58.4 million to CPI. The government

paid up on January 25, 2011. CPI posted $3.7 billion dollars in net sales the year of the decision. The fine paid by the Mexican government could have provided a year's worth of the basic food basket to more than 50,000 poor families.

CPI's wholly owned subsidiary Arancia Corn Products is among the most powerful food transnationals operating in the country, along with Maseca/Archers Daniel Midland and Cargill. Large agribusiness companies allegedly played a key role in the

2007 tortilla crisis by hoarding harvest as the international price went up, artificially drying up the national market and selling at nearly double the price they paid for the harvest.

That crisis brought tens of thousands of poor Mexicans out into the streets to protest a 50 percent rise in the price of tortillas.

NAFTA and other FTAs give corporations the power to define what we eat, what we buy at the store, who will have a job and who won't, and whether a village sustained by local food production will survive or witness the end of generations of livelihoods.

Feed the Hungry, Fix the System

Mexican organizations have begun to come together after years of divisions to respond to the food crisis and fix the badly broken system. They

recently succeeded in reforming the Mexican constitution to include the right to food. Now the battle is on to adapt the rural budget to make that right a reality.

Small farmer organizations have joined with family farm organizations in the United States and Canada to call for the

renegotiation of NAFTA to remove basic foods and agricultural production from the agreement. They recognize, though, that the Obama administration's about-face in its stated commitments to fair trade reforms have left little political space for change.

Instead, peasant organizations in all three countries are looking to grassroots efforts and movements to fix the food system before the crisis worsens. As Mexican organizations struggle for programs to address threats to food and agriculture, U.S. organizations are seeing an opportunity to join their demands to the Occupy Wall Street movement across the country. One of the grievances listed in the OWS

Declaration of the New York City General Assembly reads: "They (large corporations) have poisoned the food supply through negligence, and undermined the farming system through monopolization." Food activists are now bringing issues of corporate concentration in food, commodity speculation and price hikes, and free trade to the general protests.

Corporate control of the food system locked in by NAFTA not only starves people in Mexico. It locks in a profoundly unhealthy food system for the entire region. No one expects the situation to get better by itself. As the crisis deepens, citizen movements are again heating up and seeking each other out across borders to protect their health, their livelihoods and their rights. In the future, what we eat, how we eat, and if we eat will depend on their efforts.

Laura Carlsen is Director of the Americas Program of the Center for International Policy http://www.cipamericas.org/. based in Mexico City. She has written extensively on food and agriculture, and NAFTA. This article first appeared in Foreign Policy in Focus http://www.fpif.org/

![[Most Recent Quotes from www.kitco.com]](http://www.weblinks247.com/indexes/gfms.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/spot-copper-30d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/zinc-d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/lead-d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/spot-nickel-30d.gif)