The Latest Macro and Financial News Strongly Signal Recession Ahead

Nouriel Roubini | Dec 27, 2007

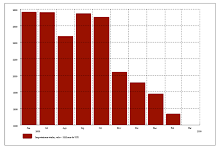

The latest macro and financial news confirm that the US is headed towards a hard landing – specifically a serious recession - as a vicious circle of worsening real fundamentals is perversely interacting with severely worsening financial fundamentals and a severe liquidity and credit crunch: Initial claims for unemployment benefits now at their recession level (i.e. level they had during the 2001 recession) and continued claims for unemployment benefits sharply up (signaling that workers losing jobs have a harder time finding new ones and are thus unemployed longer). This is now persistent trends for weeks signaling the beginning of a serious slack in the labor market.

Durable goods order falling – excluding transportation – for four months in a row; and non-defense capital goods orders and shipment falling too signaling that non-residential capex spending will show negative growth in Q4. No wonder as a slowing economy, economic/financial uncertainties and much higher corporate yield spreads (junk bond yields spreads now above 500bps compared to 200bps before the summer crisis) are taking a toll on capex spending by the corporate sector.

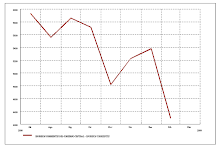

Consumer confidence still plunging (ABC/WaPo index) or sharply depressed even in December (Conference Board measure) in spite of a minor pick up in last survey. Consumer confidence close to recession levels. Polls showing that a majority of Americans expect a recession in the next 12 months.

Oil prices in the $90 to 100 range and now closer to the upper part of this range; significant negative real income effect of this increase in oil and energy prices. And overall headline and core inflation increasing.

Retail sales falling in real terms during the holiday seasons (as mediocre nominal growth was lower than inflation) and all the other indicators of holiday sales – including retailers' earnings and equity valuations showing serious gloom ahead. With consumption spending being over 70% of GDP a saving-less and debt burdened consumer that is buffeted by several shocks - falling home values, falling home equity withdrawal, rising debt servicing ratios with ARM resets, rising debt ratios, oil above $96, plunging consumer confidence, slack in the labor market - decided to throw in the towel in December and cut spending in real terms, for the first time since 2002.

The worst housing recession since the Great Depression getting worse and uglier with starts, permits, sales, prices, mortgage applications all sharply down and falling more; the only thing going up in housing is defaults, foreclosures and delinquencies.

Non-residential commercial real estate in serious trouble as a series of press reports and data suggest; CMBX index now at recession spreads.

Forward looking indicators of economic activity (Richmond Fed, Philly Fed manufacturing surveys, Index of Leading Indicators, ECRI leading indicators index) signaling weakness ahead and manufacturing ISM likely to fall below 50 (contraction level).

Corporate earnings falling 8.5% (y-o-y) in Q3 and expected to fall more in Q4 and ahead. And plunge in earnings are now spreading from home builders, to financial sector firms, to retail sector, to housing-related manufacturing and services, and overall business-cycle sensitive consumer discretionary firms. Stock market volatility still high and high nervousness and pessimism of investors (based on a variety of gauges of investors risk aversion – Vix, risk spread, etc.)

Interbank spreads (Libor vs. policy rates, TED spreads, BOR/OIS spreads, etc.) still at very elevated levels in spite of massive central bank injections and policy rate easing by Fed, BoE and BoC.

Bond yields curve and credit spreads pricing recession ahead.

Credit markets dead (subprime and subprime-related RMBs issuabce, subprime related CDOs issuance, and SIVs), comatose (near prime and prime and most of CDO and ABS issuance) or frozen (LBO deals cancelled, postponed, restructured, hundreds of leveraged loans on the balance sheet of banks, CLO issuance sharply down).

Unraveling of the $350 billion SIVs and collapse of the Super-Siv scheme forcing banks to bring back on balance sheet SIVs assets (re-intermediation), thus absorbing significant capital and liquidity and thus exacerbating the liquidity and credit crunch.

Signs of sharply increasing default rates on credit cards, auto loans and student loans leading the spreading of the credit crunch from mortgages to overall consumer credit. Banks and financial institutions have only recognized a small fraction of the total losses.

Corporate risk spreads sharply up – over 500bps – for junk bonds that were issued in massive amounts by the corporate sector in the last few years.

Monoliner bond insurance firms all under review for downgrade and one – ACA – already downgraded to C and on the verge of bankruptcy. Risk of hundreds of billions of losses for the underlying securities and issuers of insured bonds.

Massive further losses and writedowns by financial institutions that will increase as the crisis moves from subprime to near prime, prime, credit cards, auto loans, student loans, commercial real estate loans, leveraged loans, losses on ABS instruments, corporate loans. Unraveling of the Minsky credit cycle with losses reducing capital, reducing credit and exacerbating the credit crunch.

Pressures, losses and runs on non-bank financial institutions "the shadow banking system" (hedge funds, money market funds, state funds, investment banks, SIVs and conduits) that borrowed short and illiquid and lent long and illiquid that do not have direct or indirect access to the central banks' lender of last resort support.

Overall the most severe financial crisis in the Anglo-Saxon financial system in the last 20 years: crisis of insolvency and not just illiquidity; crisis of the "originate and distribute" model of securitization as wrong incentives and asymmetric information have led to a massive lack of confidence/trust in counterparties; rise of a disintermediated non-bank shadow financial system that is now in serious trouble. Need for massive reforms and regulations of the financial system.

US dollar falling and most of the financing of the still massive US current account deficit coming from central banks and SWFs, not private sector investors.

Geostrategic risks rising (being the assassination of Bhutto; unstable petro-states; high energy insecurity; political and policy uncertainty in the US as 2008 will be an election year).

Are there goods news out there? Of course there are some but many are old – relative to months before December - and backward looking:

Q3 growth being strong (but almost half of it was due to an inventory build-up and Q4 forecasts are now signaling growth below 1%);

non farm payrolls holding up in November (but initial claims for December are up and up);

personal real spending being strong in November after a weak September and October (but now December retail sales appear falling in real terms);

stock markets recovering being boosted by expectations of a Fed ease (but homebuilders, financials, retail and consumer discretionary being beaten up);

net exports improving modestly (but slowdown in global growth from re-coupling ahead will dampen the improvement in the trade balance);

hopes that a more aggressive Fed easing ahead will avoid a hard landing (but limited effects of such Fed cuts in a situation where you have a massive housing, consumer durables and auto glut; also Fed ability to ease aggressively limited by its inflation concerns and risks of a sharp inflationary fall of the dollar that may reduces foreigners investors' willingness to finance the US current account deficit);

financial institutions recapitalizing (but almost all of that recapitalization coming not from the private sectors but rather by government owned institutions – SWFs – in the Gulf, China and Singapore).

etc.: please add in the comments section any other major good news that I may have missed; I am not sure there is any.

It is thus pretty clear that the balance of the macro and financial news is strongly bearish. Thus, the most likely scenario is one of a serious US recession in 2008; the main issue now is not whether we will have a recession or not but rather how mild or severe such a recession will be.

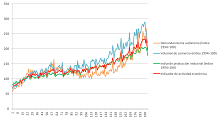

17. TASAS DE INTERES Peru

16. tipo de cambio sol/dolar-consulta del dia

V. SECCION: M. PRIMAS

1. SECCION:materias primas en linea:precios

![[Most Recent Quotes from www.kitco.com]](http://www.weblinks247.com/indexes/gfms.gif) |

METALES A 30 DIAS click sobre la imagen

(click sur l´image)

2. PRECIOS MATERIAS PRIMAS

9. prix du petrole

10. PRIX essence

petrole on line

Find out how to invest in energy stocks at EnergyAndCapital.com.

29 dic 2007

nouriel roubini : Recesion 2008

28 dic 2007

26 dic 2007

INFLACION ARGENTINA

El costo de vida: relevamientos privados sobre artículos de primera necesidad

Algunas mediciones registraron una baja de precios en las últimas semanas por la caída de los productos estacionales

Etiquetas: ECONOMIA

24 dic 2007

Suscribirse a:

Entradas (Atom)

ENTREVISTAS TV CRISIS GLOBAL

NR.: Director, no presidente

----------------------------------------------

Bruno Seminario 1

-------------------------

Bruno Seminario 2

--------------------

FELIX JIMENEZ 1

FELIZ JIMENEZ 2

FELIX JIMENEZ 3, 28 MAYO

OSCAR DANCOURT,ex presidente BCR

-------------------

Waldo Mendoza, Decano PUCP economia

----------------------

Ingeniero Rafael Vasquez, parlamentario

24 set

recordando la crisis, ver entrevista en diario

Etiquetas

- 1 MAYO

- 2

- 2002

- 2007

- 2008

- 2009

- 2010

- 2011

- 2012

- 2013

- 2014

- 2015

- 2016

- 2o11

- 2OO9

- a

- abr2015

- abril09

- abril10

- acc

- actualidadecono

- AFP

- AFPS

- AFRICA

- Ago11

- AGOS

- AGOST10

- agost12

- AGOSTO2008

- AGOSTO2009

- agosto2015

- AGRO

- AGROEXPORTACION

- AIG

- AL

- ALAGROEXPORTACION

- ALEMANIA

- ALIMENTOS

- amazonia

- AMERICALATINA

- ANDAHUAYLAS

- APEC

- ARCH MES

- ARGENTINA

- asarco

- ASIA

- ATTAC

- australia

- AUTOMOVIL

- AVAAZ

- b

- BAILOUT

- baltic

- BANCOS

- BC

- BCE

- BCRP

- benassy

- benedetti

- BERNANKE

- bernis

- BIELORUSIA

- BIS

- blanchard

- BOE

- BOJ

- BOLIVIA

- BOLSA

- BONUS

- BRASIL

- BRIC

- BUBBLE

- bundesbank

- C

- c rec

- CAFE

- CAMBIOCLIMATICO

- CAMERICAS

- CAN

- CANADA

- CANCION

- CAPITALISMO

- castro

- CDO

- cepij

- CHAVEZ

- cheque

- CHILE

- chimerica

- CHINA

- CHRYSLER

- CICLO

- CIE

- ciencia

- CIP

- COBRE

- COLOMBIA

- COMERCIO

- commodities

- COMPUTO

- CONSTRUCCION

- CONSUMO

- CONTAGIO

- control

- COPENHAGUE

- CORRUPCION

- coursera

- CRECIMIENTO

- CREDITO

- CRISIS

- CUBA

- CUMBREALCUE

- CUMBREALCUSA

- davos

- DEC08

- DEC11

- dec12

- DEC13

- dec15

- DEFICIT

- DEFLACION

- demanda

- DEPRESION

- DERIVADOS

- DEUDA

- developpement

- DIC09

- DIC10

- dic12

- DICIEMBRE

- do

- DOLAR

- doubledip

- dsk

- dubai

- duracion

- ec

- ecologo

- ECONOMIA

- ECUADOR

- EDUCA

- efectos

- EMPLEO

- EN11

- en16

- EN2016

- encuesta

- ene016

- energia

- ENERO

- ENERO09

- enero10

- EST

- eu

- EURO

- expansion

- EXPORTACION

- f

- fannie

- feb09

- feb10

- feb13

- feb15

- FED

- filo

- fin

- FINANZAS

- FINLANDIA

- fisica

- flu

- FMI

- FONDOS

- fr

- FRANCE

- frankfurt

- frontrunning

- fukushima

- G20

- G7

- GAS

- geab

- GEITHNER

- gini

- GLO

- global

- GM

- GONZALO GARCIA

- grece

- GREENSPAN

- GRENOBLE

- gripeporcina

- grupo mexico

- HAITI

- hambre

- HEDGE FUNDS

- HIPOTECA

- hist

- HOLLANDE

- HONDURAS

- IMPORTACION

- IMPUESTOS

- INDE

- INDIGNADOS

- INDUSTRIAL

- INFLACION

- INFORMALIDAD

- INFRAESTRUCTURA

- INGENIERIA

- INGENIEROS

- innova

- INTEGRACION

- INTERNACIONAL

- INVERSION

- IRAN

- IRLANDA

- ISLANDIA

- ismea

- ITALIA

- IZQ

- JAPON

- JUL11

- JULIO08

- JULIO09

- JULIO15

- JUN09

- jun10

- jun11

- JUN12

- jun13

- jun15

- JUNIO08

- keynes

- KRUGMAN

- lagarde

- LAREPUBLICA

- leap

- leverage

- liquidez

- LITIO

- lme

- LR

- macro

- MACROECONOMICS

- madera

- MADOFF

- MAMBIENTE

- MANGO

- MARS09

- mars10

- marx

- matematicas

- MATERIASPRIMAS

- MATUK

- MAY09

- MAY11

- MAY12

- MAY13

- may15

- may2015

- MAYO

- MBS

- me

- mef

- MERKEL

- METALES

- MEXICO

- miga

- MIGRA

- MINERIA

- MODELES

- MONDE

- MONEDA

- mourey

- MUJICA

- MUNDO

- musica clasica

- NACIONALIZACION

- neural

- niño

- nobel

- NOTASEMANAL

- NOV08

- nov09

- nov10

- NOV11

- NOV12

- nov15

- nuclear

- OBAMA

- OCDE

- oct09

- oct10

- OCT11

- oct12

- OCTUBRE08

- OFCE

- OIT

- OMC

- ORO

- paita

- PANAMA

- PAPA

- PARADIS

- PARAGUAY

- PAULSON

- pbi

- pe

- PEÑAFLOR

- PERU

- pesca

- PETROLEO

- piketty

- PLAN

- PMI

- POBLA

- POBREZA

- POL

- POLITICA

- porter

- portugal

- postcrisis

- PPT_CRISIS

- PRODUCCION

- PRODUCTIVIDAD

- profits

- prog

- PROTECCION

- QUIEBRA

- r

- RECESION

- REGULACION

- REMESAS

- REPEC

- REPRISE

- REPSOL

- RESERVAS

- RETAIL

- RGE

- RIESGOPAIS

- RMBS

- ROBOTICA

- RODRIK

- ROUBINI

- RUSIA

- SALARIOS

- SARKO

- school paris

- sep11

- SEP15

- SEQUIA

- SERVICIOS

- set09

- set10

- set11

- set12

- SET15

- SETIEMBRE08

- SINGAPUR

- SIRIA

- sismo

- soros

- southern

- SPAIN

- STANFORD

- STIGLITZ

- SUBPRIMES

- SUISSE

- SYRIZA

- TAIWAN

- TARIFAS

- TAS

- TCAMBIO

- TECNOLOGIA

- TERRITORIO

- TEXTIL

- TINTERES

- TLC

- TPP

- trabajo

- trentin

- TRICHET

- TROIKA

- tsunami

- TURISMO

- TV

- UBS

- UE

- UK

- UKRANIA

- UNASUR

- URUGUAY

- USA

- v

- VENEZUELA

- VIDEO

- vivienda

- WALL STREET

- WS

- wsj

- YEN

- young

- YUAN

- Zbasura

- zerohedge

Peru:crisis impacto regional arequipa,raul mauro

Temas CRISIS FINANCIERA GLOBAL

QUIEN SOY?

claves para pensar la crisis

-Tipo de cambio

- DIARIOS DE HOYNLACES

claves para pensar la crisis

MATERIAS PRIMAS

-Metales

-Cobre

- plata

- oro

- zinc

- plomo

- niquel

- petroleo

-Tipo de cambio

- LA CRISIS

- BOLSA VALORES

- BANCOS

- PBI PAISES

- USA: DEFICIT GEMELOS

- UE: RIEN NE VA PLUS

CONTAGIO: CANALES

- PERU: DIAGRAMA DE CONTAGIO

- PERU: IMPACTO EN BOLSA

- MEXICO: HAY CRISIS?

LA PRENSA

COMENTARIO DE HOY

- DIARIOS DE HOY

Coyuntura

Bancos centrales

Paginas Recomendadas

BLOGS

economiques

Interes

VIDEO

- Economia videos

- Crisis financiera global

TRICONTINENTAL

- AFRICA: daniel

- EUROPA: helene

- ASIA:

- AMERICA

COLUMNAS AMIGAS

Chachi Sanseviero

ETIQUETAS

por frecuencia de temas

por alfabetico

EVENTOS

FOTOS DEL PERU

GONZALO EN LA RED

JOBS

VOZ ME CONVERTIDOR

CLIMA

SUDOKU

PICADURAS

LOGO

LIBRO de GONZALO

La exclusion en el Peru

-Presentacion

- introduccion

- contexo economico

- crisis de la politica

- excluidos de las urbes

- excluidos andinos

- contratapa

VIDEOS ECONOMICOS

Crisis Enero 2009

Krugman

Globalizacion 1

Globalizacion 2

Crisis Brasil

Crisis bancaire

Karl marx revient

TODOS LOS DERECHOS RESERVADOS

GOOGLE INFORMA

PRESS CLIPPINGS-RECORTES PRENSA-PRESSE..

PRESS CLIPPINGS-RECORTES PRENSA-PRESSE..

canciones de GRACIAS A LA VIDA !

ETIQUETAS alfabetico

- 1 MAYO

- 2

- 2002

- 2007

- 2008

- 2009

- 2010

- 2011

- 2012

- 2013

- 2014

- 2015

- 2016

- 2o11

- 2OO9

- a

- abr2015

- abril09

- abril10

- acc

- actualidadecono

- AFP

- AFPS

- AFRICA

- Ago11

- AGOS

- AGOST10

- agost12

- AGOSTO2008

- AGOSTO2009

- agosto2015

- AGRO

- AGROEXPORTACION

- AIG

- AL

- ALAGROEXPORTACION

- ALEMANIA

- ALIMENTOS

- amazonia

- AMERICALATINA

- ANDAHUAYLAS

- APEC

- ARCH MES

- ARGENTINA

- asarco

- ASIA

- ATTAC

- australia

- AUTOMOVIL

- AVAAZ

- b

- BAILOUT

- baltic

- BANCOS

- BC

- BCE

- BCRP

- benassy

- benedetti

- BERNANKE

- bernis

- BIELORUSIA

- BIS

- blanchard

- BOE

- BOJ

- BOLIVIA

- BOLSA

- BONUS

- BRASIL

- BRIC

- BUBBLE

- bundesbank

- C

- c rec

- CAFE

- CAMBIOCLIMATICO

- CAMERICAS

- CAN

- CANADA

- CANCION

- CAPITALISMO

- castro

- CDO

- cepij

- CHAVEZ

- cheque

- CHILE

- chimerica

- CHINA

- CHRYSLER

- CICLO

- CIE

- ciencia

- CIP

- COBRE

- COLOMBIA

- COMERCIO

- commodities

- COMPUTO

- CONSTRUCCION

- CONSUMO

- CONTAGIO

- control

- COPENHAGUE

- CORRUPCION

- coursera

- CRECIMIENTO

- CREDITO

- CRISIS

- CUBA

- CUMBREALCUE

- CUMBREALCUSA

- davos

- DEC08

- DEC11

- dec12

- DEC13

- dec15

- DEFICIT

- DEFLACION

- demanda

- DEPRESION

- DERIVADOS

- DEUDA

- developpement

- DIC09

- DIC10

- dic12

- DICIEMBRE

- do

- DOLAR

- doubledip

- dsk

- dubai

- duracion

- ec

- ecologo

- ECONOMIA

- ECUADOR

- EDUCA

- efectos

- EMPLEO

- EN11

- en16

- EN2016

- encuesta

- ene016

- energia

- ENERO

- ENERO09

- enero10

- EST

- eu

- EURO

- expansion

- EXPORTACION

- f

- fannie

- feb09

- feb10

- feb13

- feb15

- FED

- filo

- fin

- FINANZAS

- FINLANDIA

- fisica

- flu

- FMI

- FONDOS

- fr

- FRANCE

- frankfurt

- frontrunning

- fukushima

- G20

- G7

- GAS

- geab

- GEITHNER

- gini

- GLO

- global

- GM

- GONZALO GARCIA

- grece

- GREENSPAN

- GRENOBLE

- gripeporcina

- grupo mexico

- HAITI

- hambre

- HEDGE FUNDS

- HIPOTECA

- hist

- HOLLANDE

- HONDURAS

- IMPORTACION

- IMPUESTOS

- INDE

- INDIGNADOS

- INDUSTRIAL

- INFLACION

- INFORMALIDAD

- INFRAESTRUCTURA

- INGENIERIA

- INGENIEROS

- innova

- INTEGRACION

- INTERNACIONAL

- INVERSION

- IRAN

- IRLANDA

- ISLANDIA

- ismea

- ITALIA

- IZQ

- JAPON

- JUL11

- JULIO08

- JULIO09

- JULIO15

- JUN09

- jun10

- jun11

- JUN12

- jun13

- jun15

- JUNIO08

- keynes

- KRUGMAN

- lagarde

- LAREPUBLICA

- leap

- leverage

- liquidez

- LITIO

- lme

- LR

- macro

- MACROECONOMICS

- madera

- MADOFF

- MAMBIENTE

- MANGO

- MARS09

- mars10

- marx

- matematicas

- MATERIASPRIMAS

- MATUK

- MAY09

- MAY11

- MAY12

- MAY13

- may15

- may2015

- MAYO

- MBS

- me

- mef

- MERKEL

- METALES

- MEXICO

- miga

- MIGRA

- MINERIA

- MODELES

- MONDE

- MONEDA

- mourey

- MUJICA

- MUNDO

- musica clasica

- NACIONALIZACION

- neural

- niño

- nobel

- NOTASEMANAL

- NOV08

- nov09

- nov10

- NOV11

- NOV12

- nov15

- nuclear

- OBAMA

- OCDE

- oct09

- oct10

- OCT11

- oct12

- OCTUBRE08

- OFCE

- OIT

- OMC

- ORO

- paita

- PANAMA

- PAPA

- PARADIS

- PARAGUAY

- PAULSON

- pbi

- pe

- PEÑAFLOR

- PERU

- pesca

- PETROLEO

- piketty

- PLAN

- PMI

- POBLA

- POBREZA

- POL

- POLITICA

- porter

- portugal

- postcrisis

- PPT_CRISIS

- PRODUCCION

- PRODUCTIVIDAD

- profits

- prog

- PROTECCION

- QUIEBRA

- r

- RECESION

- REGULACION

- REMESAS

- REPEC

- REPRISE

- REPSOL

- RESERVAS

- RETAIL

- RGE

- RIESGOPAIS

- RMBS

- ROBOTICA

- RODRIK

- ROUBINI

- RUSIA

- SALARIOS

- SARKO

- school paris

- sep11

- SEP15

- SEQUIA

- SERVICIOS

- set09

- set10

- set11

- set12

- SET15

- SETIEMBRE08

- SINGAPUR

- SIRIA

- sismo

- soros

- southern

- SPAIN

- STANFORD

- STIGLITZ

- SUBPRIMES

- SUISSE

- SYRIZA

- TAIWAN

- TARIFAS

- TAS

- TCAMBIO

- TECNOLOGIA

- TERRITORIO

- TEXTIL

- TINTERES

- TLC

- TPP

- trabajo

- trentin

- TRICHET

- TROIKA

- tsunami

- TURISMO

- TV

- UBS

- UE

- UK

- UKRANIA

- UNASUR

- URUGUAY

- USA

- v

- VENEZUELA

- VIDEO

- vivienda

- WALL STREET

- WS

- wsj

- YEN

- young

- YUAN

- Zbasura

- zerohedge

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/spot-copper-30d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/zinc-d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/lead-d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/spot-nickel-30d.gif)